Featured

Real Estate Investment Trust Etf

Its a publicly traded company that owns operates or finances income-producing assets involving real estate. Its inception date was June 12 2000.

Reits Aren T A True Alternative Morningstar

Reits Aren T A True Alternative Morningstar

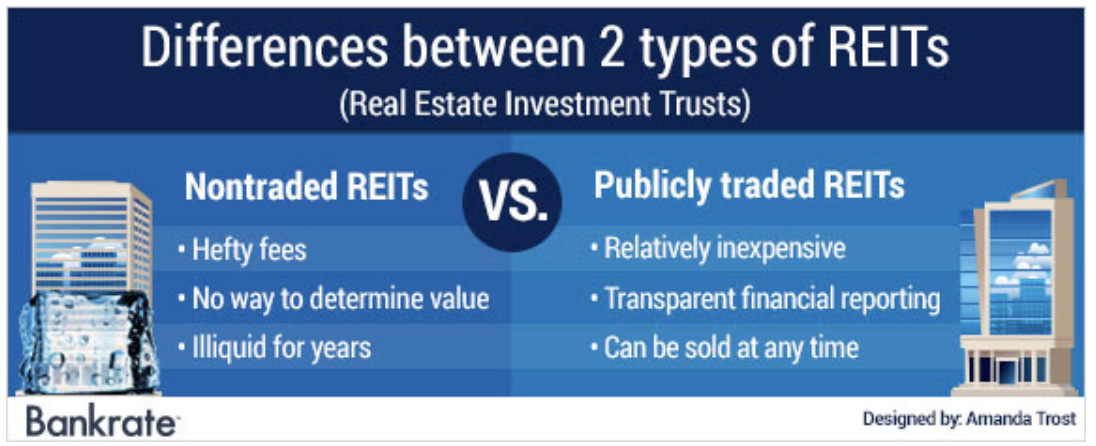

These are known as publicly traded REITs.

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg)

Real estate investment trust etf. Listed real estate companies and Real Estate Investment Trust ETFs. Real estate investment trust exchange-traded funds or REIT ETFs offer many benefits to a fixed-income portfolio such as capital appreciation and. Real Estate ETF.

Listed real estate companies and REITs differ fundamentally from other asset classes and their unique properties could make them ideal portfolio diversifiers. SPDR Dow Jones REIT ETF. A REIT ETF is a type of fund made up exclusively of REIT stocks.

Real estate investment trusts are companies that own operate or finance income-generating real estate and offer investors a way to invest in the real estate sector without having to buy or. Vanguard Real Estate ETF. The stand-out offering within the domestic segment is the Vanguard Australian Property Securities Index ETF VAP which earns Morningstars Gold rating.

They give shareholders a slice of ownership in a property or portfolio of properties and guarantee a certain percentage of the profit gets paid out in dividends. Here are the best Real Estate Funds ETFs. A Real Estate Investment Trust REIT is a security that trades like a stock on the major exchanges and ownsand in most cases operatesincome-producing real estate or related assets.

Many REITs are registered with the SEC and are publicly traded on a stock exchange. They typically focus on commercial property shopping malls hotels office blocks etc rather than residential they are tradeable on the stock exchange and they pool investors cash in diversified holdings - think of them as the equivalent of mutual. The oldest Real Estate ETF is the iShares US.

Real estate investment trusts REITs and sector-related exchange traded funds ETFs are a good source of attractive payouts in a low-yield environment. IShares Core US REIT ETF. Kijk ook naar REIT ETFs als product naast gewone investeringen in Real Estate Investment Trusts.

WRE has around 187M shares in the US. The REIT ETF universe is comprised of about 30 distinct ETFs that trade in the US excluding inverse and leveraged ETFs as well as funds with. Door ook in een REIT ETF te beleggen verspreid je het risico dat je neemt met je investeringen nog meer en zorg je ervoor dat de kans op grote verliezen minimaal blijft.

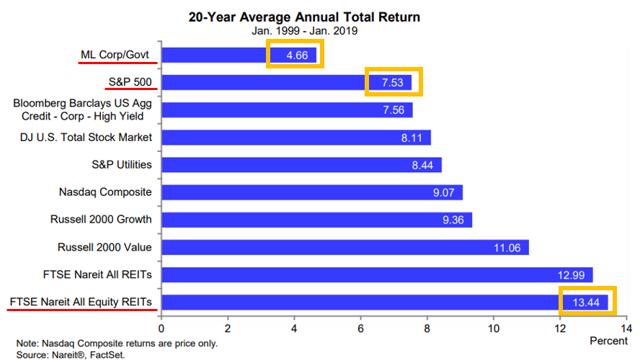

The most common REITs involve real estate properties that generate revenue from rents think apartment buildings. Since inception this ETF has outperformed an SP 500 index fund by 413 CAGR with a relatively low correlation to US Markets of 065. Real Estate Investment Trust Index.

A REIT is also known as a Real Estate Investment Trust. IYR vs SP 500 Index fund. Real Estate Select Sector SPDR iShares Global REIT ETF.

Real Estate Investment Trusts REITs are companies that directly own operate or finance income-producing property. REIT ETFs also grant a good diversification option to investors. Each of these exchange-traded funds take a slightly different slant on listed real estate investment trusts three of them focusing on Australia and one tracking global REITs.

Real estate investment trusts or REITs are a great way to invest in real estate for a variety of reasons. Washington Real Estate Investment Trust is a company in the US. 12 rows See all ETFs tracking the Wilshire US.

Note that there are. Their correlation with general stockmarkets is often low while they also act as a natural inflation hedge and. Real Estate ETFs invest in the US.

Stock market and it is a holding in 77 US-traded ETFs. REIT stands for real estate investment trust and a REIT is a particular type of investment vehicle thats designed to allow multiple investors to put their money together into a common pool for. April 14 2021.

July 2000 August 2019. It reduces the risk for an investor who is betting on just one property of his own. Real estate portfolios invest primarily in real estate investment trusts of various types.

REITs are companies that develop and manage real estate properties. June 19 2000 September 13 2019. Canadian REIT ETFs provide attractive investment attributes of real estate investment as it invests in several property-owning real estate companies in one go.

Global Reits Why Invest In Global Real Estate

Global Reits Why Invest In Global Real Estate

Reits Vs Private Equity Funds What S The Best Way To Invest In Real Estate Seeking Alpha

Reits Vs Private Equity Funds What S The Best Way To Invest In Real Estate Seeking Alpha

3 Things Robinhood Traders Should Consider Before Investing In Mortgage Reits The Motley Fool

3 Things Robinhood Traders Should Consider Before Investing In Mortgage Reits The Motley Fool

Use Reits To Invest Like A Property Mogul Wsj

Use Reits To Invest Like A Property Mogul Wsj

Reit Etfs The Ultimate Singaporean Guide To Investing In Em

Reit Etfs The Ultimate Singaporean Guide To Investing In Em

Real Estate Crowdfunding Vs Real Estate Etfs Seeking Alpha

Real Estate Crowdfunding Vs Real Estate Etfs Seeking Alpha

Reit Investing What Is A Reit Ally

Reit Investing What Is A Reit Ally

Global Reits Why Invest In Global Real Estate

Global Reits Why Invest In Global Real Estate

/dotdash_Final_How_to_Assess_a_Real_Estate_Investment_Trust_REIT_Nov_2020-01-d11e2a73dcd74c80b629e0f3068f85d8.jpg) How To Assess A Real Estate Investment Trust Reit

How To Assess A Real Estate Investment Trust Reit

A Real Estate Fund With Focus Kiplinger

A Real Estate Fund With Focus Kiplinger

Should You Invest In Reits Ally

Should You Invest In Reits Ally

Global Reits Why Invest In Global Real Estate

Global Reits Why Invest In Global Real Estate

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg) How To Analyze Reits Real Estate Investment Trusts

How To Analyze Reits Real Estate Investment Trusts

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

Comments

Post a Comment