Featured

When Is Libor Going Away

Is LIBOR Still Going Away in 2021. The Hong Kong Monetary Authority HKMA and the Treasury Markets Association TMA updated its timeline to cease the issuance of new LIBOR-linked products by the end of 2021.

Other tenors will continue to be published for existing legacy loans until June 30 2023.

When is libor going away. When is LIBOR Going Away. This aligns with guidance published by the Federal Reserve Board Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency. By Davida Farrar OCT 17 2019.

While most Libor rates will be phased out at the end of 2021 the sheer enormity of the task - made more difficult by the coronavirus pandemic - has prompted global regulators to delay the timeline. UBS executives denied all knowledge of what had been going on although the ring managed to manipulate rate submissions across multiple institutions. As part of this benchmark reform its likely that LIBOR will be discontinued after 2021 when its UK regulator will no longer compel banks to submit rates needed to publish the benchmark.

Another thing that is happening here is that ICE will stop. While the original deadline was Dec. Sometime after 2021 LIBOR is expected to be discontinued.

According to the announcement banks should stop writing contracts using LIBOR by the end of 2021 after which the rate no longer will be published. One-week and two-month LIBOR will be discontinued on Dec. Many financial contracts typically underwritten or.

In the summer of 2017 Andrew Bailey made headlines by putting an actual timetable on the replacement of LIBOR by the end of 2021. This change will affect some adjustable or variable rate loans and lines of credit like adjustable-rate mortgages ARMs reverse mortgages home equity lines of credit credit cards auto loans student loans and any. The global financial industry is preparing to transition away from a key benchmark interest rate the London Interbank Offered Rate or LIBOR to new alternative rates.

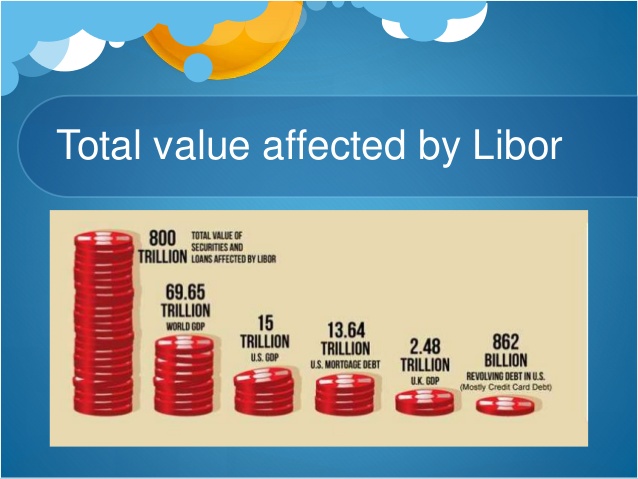

LIBOR is expected to go away sometime after 2021. While US and global regulators have been vociferous about the demise of Libor for obvious reasons it is not underpinned by market transactions is increasingly subject to expert judgement and is burdened by the weight of past market abuses the sheer enormity of transitioning this 370 trillion problem with a global reach might cause one to question whether the inevitability of Libor going away. The FCA has secured panel bank support to continue submitting to LIBOR but only until 2021.

The underlying market LIBOR measures is no longer liquid. Regulators currently require participating banks to submit a LIBOR survey each day but after 2021 they will not. LIBOR is going away.

Beyond this date the future of LIBOR is not guaranteed. A global effort is now under way to transition market participants to alternative reference rates. Will Libor Disappear in 2021.

The expected discontinuation of LIBOR is important for community banks because they may have LIBOR exposures on the asset or liability side of the balance sheet at the bank andor bank holding company. In July 2017 Andrew Bailey Chief Executive of the FCA announced that LIBOR rates would only be formally sustained by the FCA through the end of 2021 due to limited market activity around LIBOR benchmarks and the declining contributions of panel banks. Regulators have called for a market-wide transition away from new LIBOR exposures by the end of 2021.

All LIBOR Currencies Were Scheduled to Go Away in 2021 Ever since the FCAs July 2017 statement that it no longer intended to persuade or compel banks to submit to LIBOR after 31 December 2021 the industry has been working on the transition away from LIBOR. Heres what you need to know. So at the end of the year it will mostly stop though it will keep going for the main tenors of US.

This change will affect some adjustable or variable rate loans and lines of credit like adjustable-rate mortgages ARMs reverse mortgages home equity lines of credit credit cards auto loans student loans and any other personal loans that use LIBOR. LIBOR is often used to hedge the general level of interest rates for which it is inefficient given it includes a term bank credit component. Sometime after 2021 LIBOR is expected to be discontinued.

31 2021 the Federal Financial Institutions Examination Council announced at the end of November that only the one-week and two-month USD LIBOR settings would end in 2021 and the remainder of LIBOR ratesincluding the most popular the three-month ratewould continue to be published through June 30 2023 to allow most contracts to mature before LIBOR ends. Libor is calculated from an average of banks that participate in overnight lending to each other. Dollar Libor until June 2023.

The concern is that the banks will stop submitting to this survey and there will be no LIBOR.

The End Of Libor For Insurance Pwc

The End Of Libor For Insurance Pwc

Libor Replaced Will Your Mortgage Be More Expensive Now Ready For Sofr Fairview Commercial Lending

Libor Replaced Will Your Mortgage Be More Expensive Now Ready For Sofr Fairview Commercial Lending

What Is Libor Why Is It Going Away

What Is Libor Why Is It Going Away

Why Libor Will Disappear And What It Means For You Brink News And Insights On Global Risk

Why Libor Will Disappear And What It Means For You Brink News And Insights On Global Risk

The Global Move Away From Libor

The Global Move Away From Libor

Is Libor Still Going Away In 2021 Industry News Pensford

Is Libor Still Going Away In 2021 Industry News Pensford

Libor Is Due To Die In 2021 Hurry Up And Drop It Say Regulators The Economist

Libor Is Due To Die In 2021 Hurry Up And Drop It Say Regulators The Economist

Libor Brought Scandal Cost Billions And May Be Going Away The New York Times

Libor Brought Scandal Cost Billions And May Be Going Away The New York Times

What Is Libor Why Is It Going Away

What Is Libor Why Is It Going Away

The Sunset Of Libor And The Rise Of Sofr What You Need To Know Rebusinessonline

The Sunset Of Libor And The Rise Of Sofr What You Need To Know Rebusinessonline

6 Things To Know About Libor Transition Heading Into 2020 Intralinks

6 Things To Know About Libor Transition Heading Into 2020 Intralinks

Comments

Post a Comment