Featured

Federal Fuel Tax

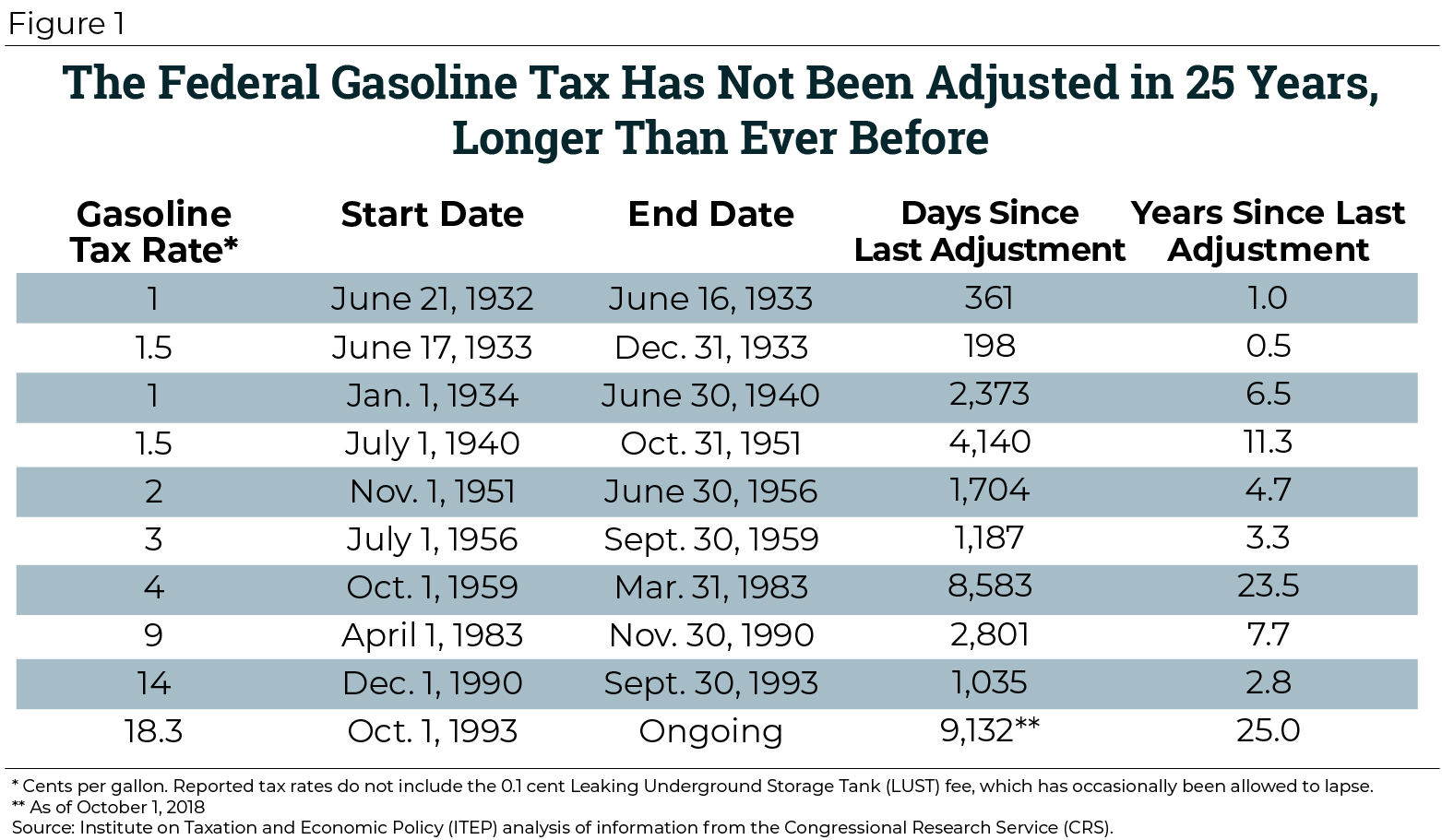

That is a factor of almost 5 over the 5 years. 1 2 The federal tax was last raised October 1 1993 and is not indexed to inflation which increased by a total of 77 percent from 1993 until 2020.

When You Buy A Gallon Of Gas How Much Of The Price Is Tax Quora

The federal government charges a tax of 184 cents on every gallon of gasoline and 244 cents on every gallon of diesel.

Federal fuel tax. Unless it is extended a 1-per-gallon federal biodiesel tax credit would expire at the end of 2022. These rates are not automatically adjusted for inflation. This tax pays for infrastructure projects and mass transportation costs and it includes a 01 cent per gallon fee that goes to the Leaking Underground Storage Tank trust fund.

Information on the refund of second tax is included. The federal tax rate on diesel fuel is 243 cents per gallon. Ryans Fuels and Excise Tax experts work with our clients to solve a variety of issues such as performing overpayment reviews that result in state and federal fuels tax refund opportunities on fuel consuming equipment.

Where appropriate the weighted average also takes. The gasoline tax is an excise tax which is a cost added to the purchase of specific goods and services. Similar to gasoline a 01 cent per gallon fee is.

APIs chart reflects a weighted average for each state meaning that any taxes which can vary across a states jurisdiction are averaged according to the population of the local areas subject to each particular tax rate. Furnace oil is exempt from this tax and there is no federal excise tax on natural gas or propane. What Is the Fuel Tax Credit.

A separate 50 cents-per-gallon alternative fuels mixture tax credit would expire a year. Charge on fuel held in a listed province on adjustment day Who has to pay a charge on fuel held in a listed province on adjustment day exceptions to the charge and how to file the return. Looking at the tax estimates for FY2020 to FY 2024 total renewable fuel tax incentives are 571 billion while fossil fuels tax incentives are 123 billion.

The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. Our professionals also have the industry expertise to conduct audit support for state or federal fuels tax audits. First authorized by Congress in 1932 to help balance the federal budget the federal gas tax is now used to pay for building and maintaining interstate highways and bridges.

The federal government granted more than 13 billion in direct and indirect subsidies to fossil fuels in 2019 according to the first inventory drawn up by the FPS Finance and the FPS Environments Climate Change Department as part of the requirements of. API collects motor fuel tax information for all 50 states and compiles a report and chart detailing changes and calculating a nationwide average. Filing an exemption certificate for relief of the fuel charge.

Under current law the excise tax rate is 183 cents per gallon on gasoline and 243 cents per gallon on diesel fuel. The taxes and other fees on retail gasoline and diesel fuel in cents per gallon as of January 1 2021 Federal taxes include excises taxes of 183 cents per gallon on gasoline and 243 cents per gallon on diesel fuel and a Leaking Underground Storage Tank fee of 01 cents per gallon on both fuels. The rate of tax is 243 cents per gallon in the case of liquefied natural gas any liquid fuel.

This chapter also explains credits and refunds for the biodiesel or renewable diesel mixture credits and the alternative fuel mixture and alternative fuel credits. There are different types of taxes on transportation and heating fuel. 23 Zeilen Heavy fuel oil.

Drivers now pay 184 cents a gallon in the federal gas tax. In addition to the federal tax each state adds its own tax to every gallon of gas sold in the state. A 01 cents per gallon tax is also levied on top of these fuel tax rates to help fund expenses associated with fuel regulation.

The federal government charges an excise tax at a flat rate of 10 cents per litre on gasoline in effect at that rate since 1995 and 4 cents per litre on diesel in effect at that rate since 1987. 2 A 01 cents per gallon tax is also levied on top of these fuel tax rates to help fund. This chapter lists the nontaxable uses of each fuel and defines the nontaxable uses.

52 Zeilen The current federal motor fuel tax rates are. The federal gasoline excise tax is 184 cents per gallon as of 2020. Federal excise taxes are imposed on certain fuels as discussed in chapter 1.

The federal government levies an excise tax on various motor fuels intended for highway use1 Under current law the tax rate is 183 cents per gallon on gasoline and 243 cents per gallon on diesel fuel. In general the Internal Revenue Code imposes a federal fuel tax at the retail level on any liquid other than gasoline. Fuels and Excise Tax Services.

Fuel Tax The federal government levies an excise tax on various motor fuels. Clearly the fossil fuel industry does not get 40 billion in tax incentives from the federal government as President Biden has stated. On top of that youll also face location-based gas taxes.

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types. Securing fuels and excise tax refund.

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

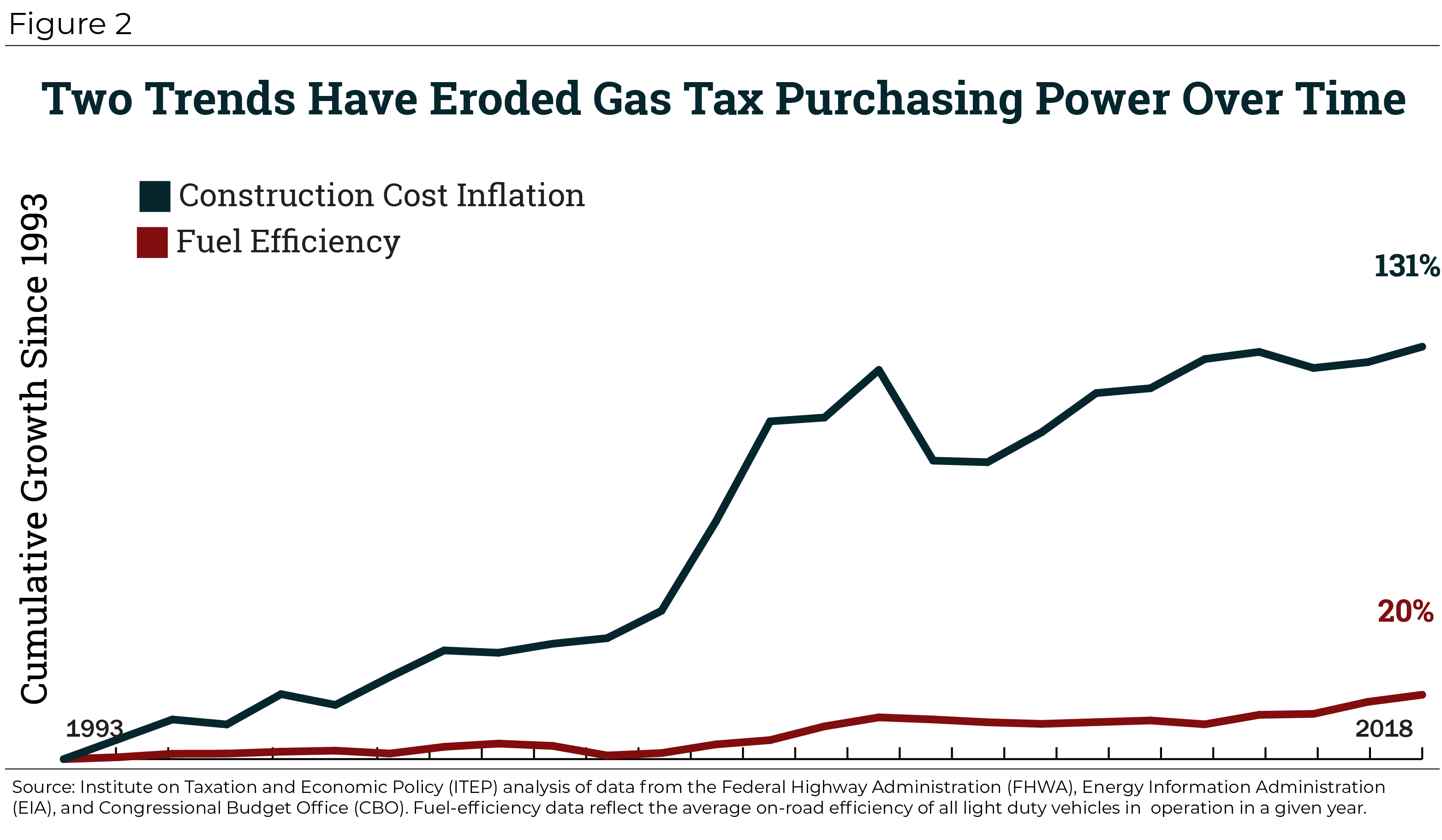

Failure To Keep Up Gasoline Taxes Has Crippled Highway Construction An Economic Sense

Failure To Keep Up Gasoline Taxes Has Crippled Highway Construction An Economic Sense

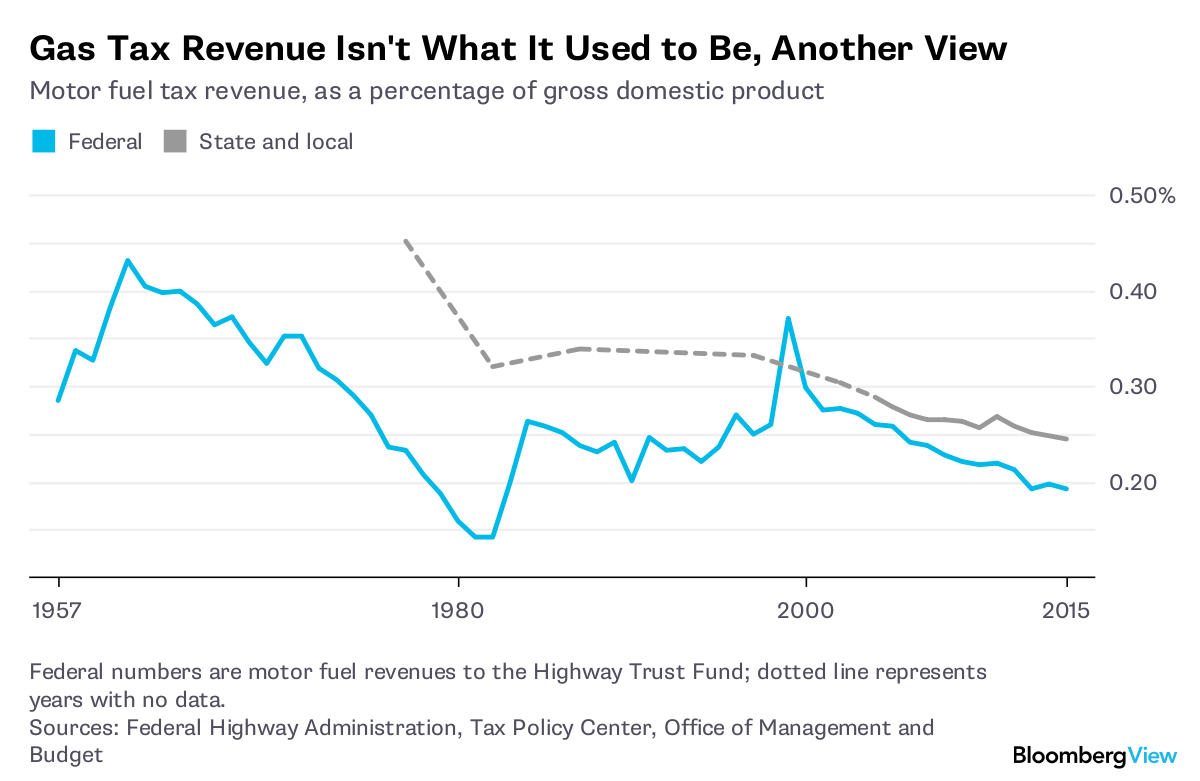

Gas Taxes Aren T Paying The Bills For Roads Anymore Bloomberg

Gas Taxes Aren T Paying The Bills For Roads Anymore Bloomberg

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Motor Fuels Taxes Diesel Technology Forum

Motor Fuels Taxes Diesel Technology Forum

Https Www Cdmsmith Com Media White Papers Ed Regan Motor Fuel Tax Risks Mbuf Opportunities White Paper Pdf

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

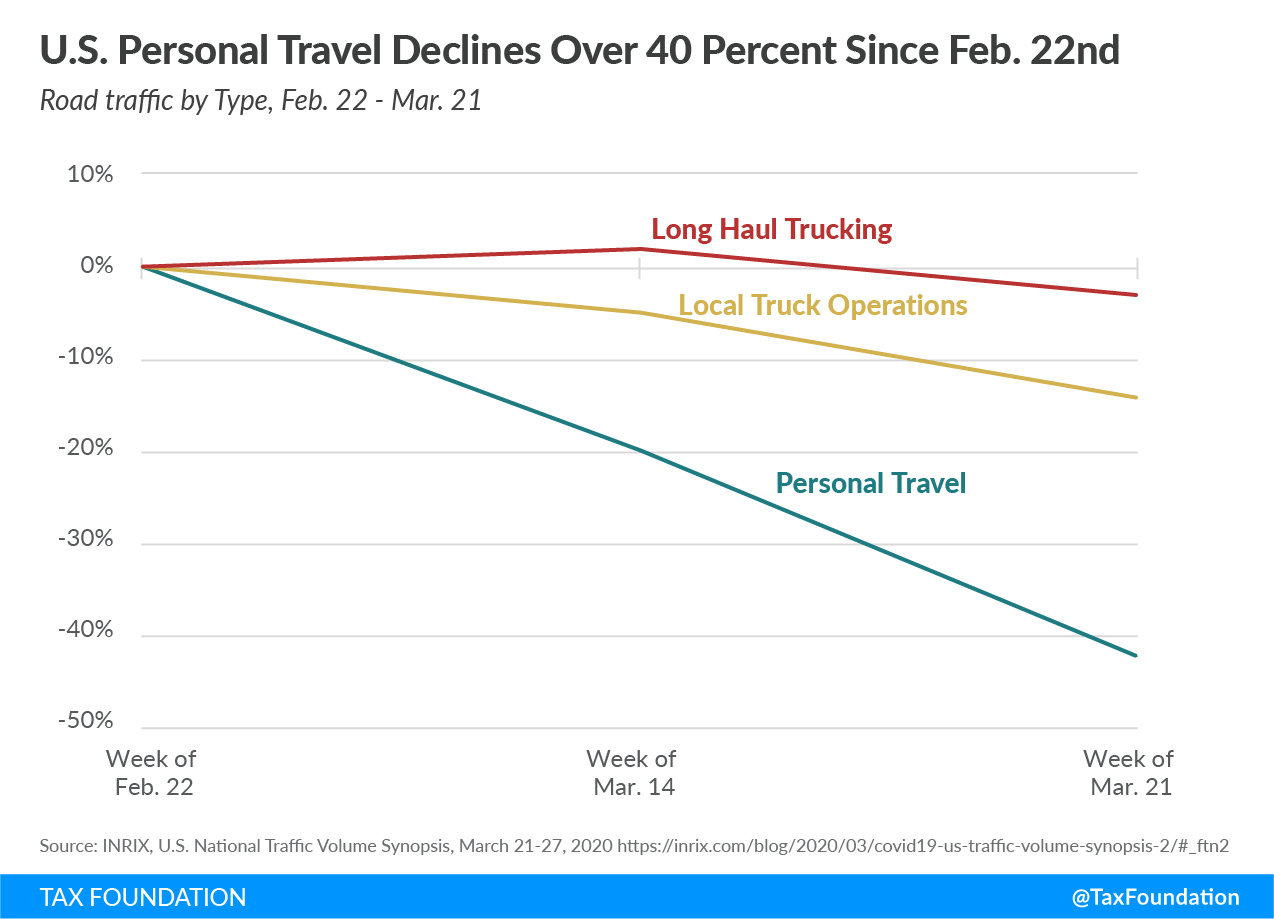

Gas Tax Revenue To Decline As Traffic Drops 38 Percent

Gas Tax Revenue To Decline As Traffic Drops 38 Percent

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

The Federal Gasoline Tax Should Be Abolished Not Increased Mercatus Center

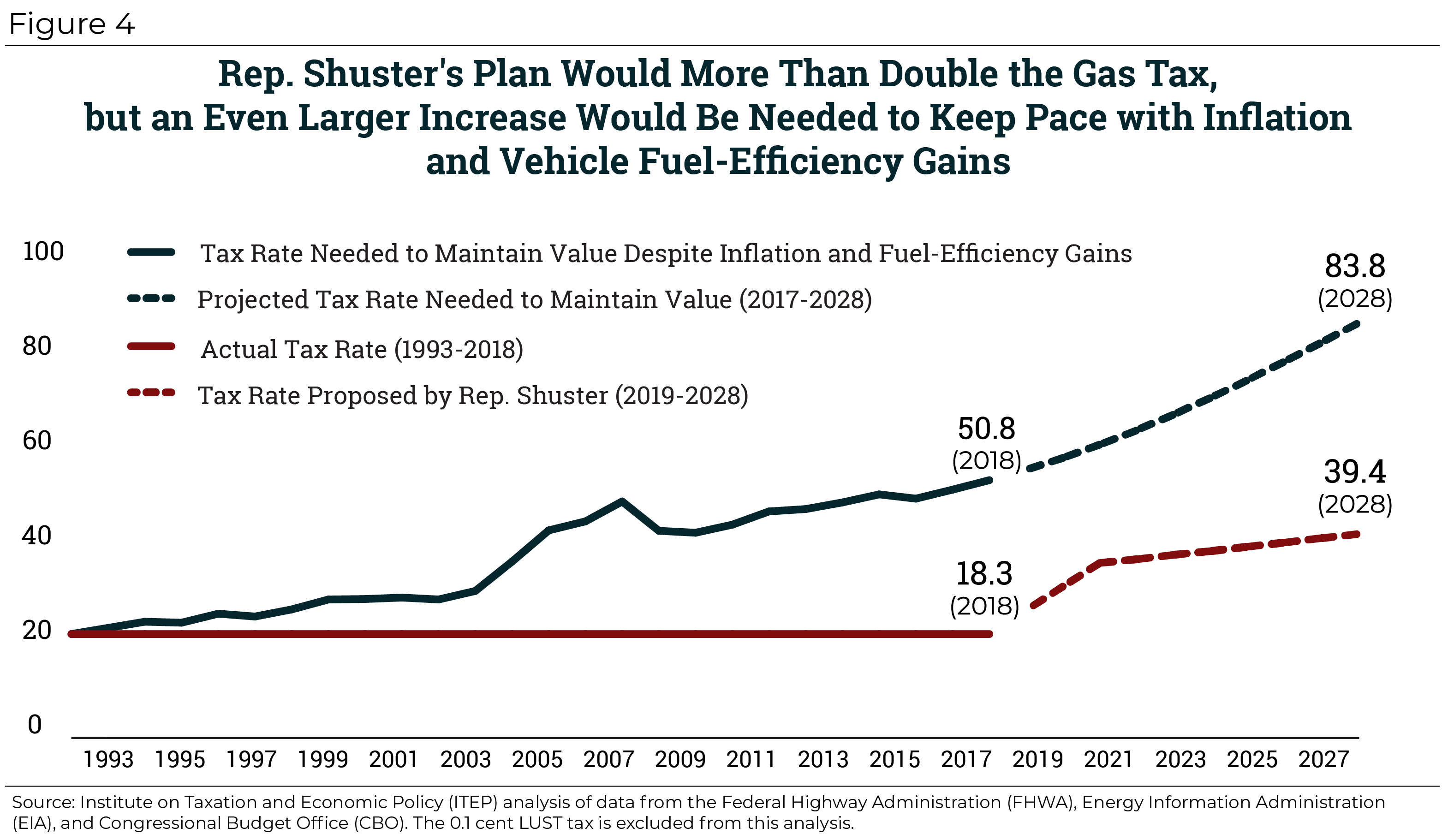

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

Federal Excise Tax Rate On Gasoline Ff 02 17 2020 Tax Policy Center

Federal Excise Tax Rate On Gasoline Ff 02 17 2020 Tax Policy Center

Comments

Post a Comment