Featured

Nassau County Taxes Due

Deadline to file a 202223 Nassau County tax grievance. School town county and village taxes are subject to annual review and.

The Nassau County Treasurers Office has resumed limited in person access.

Nassau county taxes due. Nassau cities due dates period covered. Cuomo granted the extension on Thursday. Second Half 2020-2021 School Tax due.

2021 Tax Payment Schedule. The Nassau County Treasurers Office is located at 1 West Street in Mineola and. Payable without penalty to 021021.

202021 2nd half School Tax payments are due to the Receiver of Taxes. Payable without penalty to 051021. If it is after 400 PM please submit payments the next day.

Building Engineering and Planning Departments cannot currently accept online payments after 400 PM. Ad Valorem taxes are collected on an annual basis beginning November 1st and are based on that calendar year from January 1st through December 31st. Where possible it is recommended that delinquent 2020 taxes be paid online at httpsappnassaucountynygovtreasurerdelinquent_tax.

Second Half 2020-2021 School Tax due. Nassau County Tax Lien Sale. First Half 2021 General Tax due.

Earlier Monday the Nassau County Legislature voted unanimously to extend until June 10 the deadline for filing property taxes without interest or penalties to help residents who are struggling. First Half 2021 General Tax due. The majority of tax changes are under.

General Tax Deadline Extended In Nassau County North Hempstead The last day to pay the first half of 2021 general taxes without a penalty is now Friday March 12. 2021 2nd half General Tax bills are issued by the County. Nassau County taxpayers have an extra 30 days until March 12 to pay their first-half general taxes without interest or penalty after Gov.

Hours of operation are 900am to 430pm Monday through Friday. Approximately 11 of the total tax increases this year stem from increases in school districts budgets County Executive Laura Curran said in a statement. Assessment Challenge Forms Instructions.

Delinquent School Taxes are collected by the Treasurers Office beginning June 1st and delinquent General Taxes are collected by the Treasurers Office beginning September 1st. Please click the link below to be directed to our online payment portal. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value.

Payable without penalty until 031221. Rules of Procedure PDF Information for Property Owners. Feb 10 2021 Moved to Mar 12 2021.

In early December 2020 Nassau County Executive Laura Curran announced an assessment freeze for the 20222023 tax year. This freeze affects all residential and commercial properties in Nassau County except newly constructed housing and new land lots. Nassau County Property Tax Appeal Nassau County calculates the property tax due based on the fair market value of the home or property in question as determined by the Nassau County Property Tax Assessor.

There is a 100 service-charge or you may pay by credit card for a 23 bank charge. Payable without penalty to 051021. The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of delinquency.

Last day to pay First Half 2021 General Tax without penalty. The Department of Highway Safety and Motor Vehicles allows the Tax Collector to register vehicles and vessels. Second Half 2020-2021 School Tax due.

Can my taxes be reduced. Payments after this date are subject to penalties. Tax notices are mailed to the owners address as it appears on the certified tax roll normally on or before November 1st.

Last day to pay Second Half 2020-2021 School tax without penalty. Last day to pay First Half 2021 General Tax without penalty. How to Challenge Your Assessment.

City of long beach county jan 1 jul 1 jan 1 to dec 31 school oct 1 apr 1 jul 1 to jun 30 city jul 1 jan 1 jul 1 to jun 30. What Nassau Countys 202223 Assessment Freeze Means for You. First Half 2021 General Tax AutoPay transaction process date.

Payable without penalty to 021021. Deadline to file a 202122 City of Glen Cove grievance. Feb 10 2021 Moved to Mar 12 2021.

Payable without penalty to 051021. Nassau County Property Tax Grievance Deadline is April 30 2021. Each year more and more Nassau County residents are taking advantage of existing appeal procedures that have resulted in millions of dollars in overall tax reductions and thousands of dollars in individual tax savings.

First Half 2021 General Tax due. First Half 2021 General Tax AutoPay transaction process date. Last day to pay First Half 2021 General Tax without penalty.

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

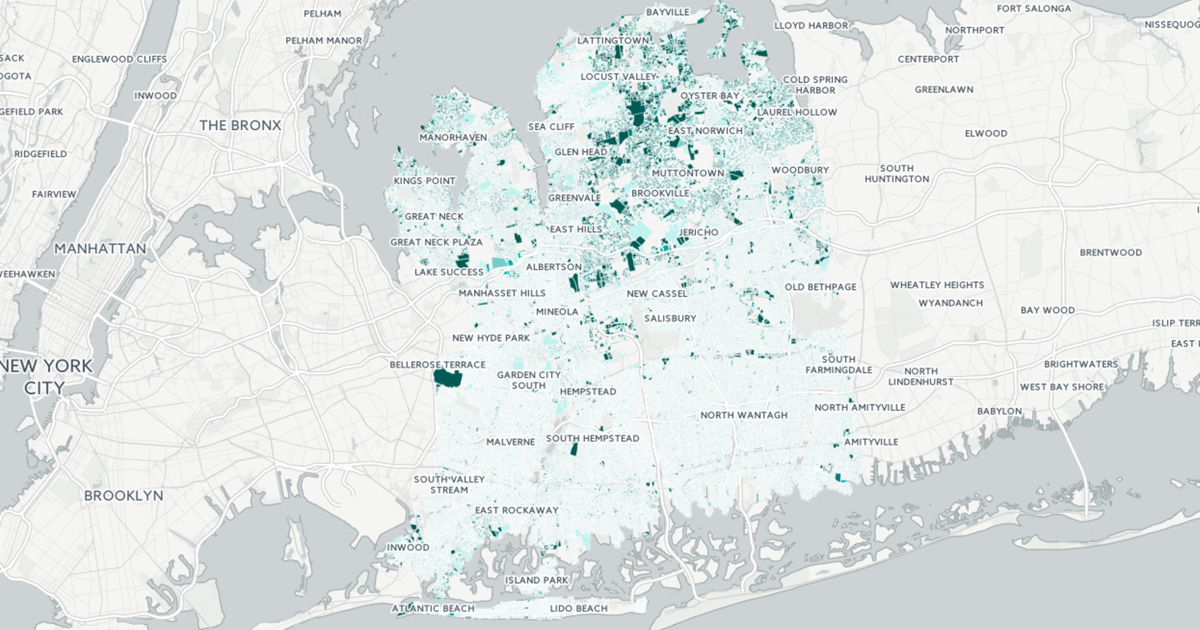

Nassau County S Property Tax Game The Winners And Losers

Nassau County S Property Tax Game The Winners And Losers

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Make Sure That Nassau County S Data On Your Property Agrees With Reality

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Ny Official Website

Nassau County Ny Official Website

Sticker Shock Long Island Business News

Sticker Shock Long Island Business News

Nassau County Extends Property Tax Deadline To June 1

Nassau County Extends Property Tax Deadline To June 1

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

All The Nassau County Property Tax Exemptions You Should Know About

All The Nassau County Property Tax Exemptions You Should Know About

Comments

Post a Comment