Featured

- Get link

- X

- Other Apps

Fidelity Wealth Management Minimum

Minimum investment is 50000 for access to a team of advisors and 250000 for access to a dedicated advisor. Advisory offering through Fidelity Wealth Services or Fidelity Strategic Disciplines Minimum investment.

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Private Wealth Management The highest level of service that Fidelity offers is with a Fidelity Private Wealth Management account.

Fidelity wealth management minimum. Sie müssen JavaScript aktivieren um diese App auszuführen. Fidelity Wealth Services is an investment advisory service that provides nondiscretionary financial planning and discretionary investment management through one or more Portfolio Advisory Services accounts for a fee. They have required minimum investments ranging from 50000 to 2 million.

Knowing where you stand is crucial. Fidelity also offers a simpler wealth management service where you work with an individual advisor and requires a 250000 account minimum. 2 million managed through Fidelity Wealth.

Fidelity is also giving eligible wealth management clients free online options trades with an unlimited number for those with at least 2 million invested. Your Fidelity advisor will provide access to planning and ongoing investment management based on your financial picture. With no account fees 0 commission trades and no minimums to open an account we can help your money go further.

Überwachung des Marktes durch Algorithmen. Fidelity Private Wealth Management. You can invest with a digital advisorFidelity GoFidelitys robo-advisor platform or partner with a Fidelity investment professional.

250000 managed through Fidelity Wealth Services 6. Vanguard another online brokerage offers a range of. Meanwhile Betterment charges 025 on balances up to 10000.

So 5000 Assets under Management rate amount of assets that Fidelity must manage for us. 250000 managed through Fidelity Wealth Services 3. Sie müssen JavaScript aktivieren um diese App auszuführen.

Your Fidelity advisor will provide access to planning and ongoing investment management based on your financial picture. Fidelity Personalized Planning Advice is not currently designed for clients who are retired within three years of retirement or in need of retirement. Sinnvolle Anpassungen bei Marktveränderungen.

Use this tool to see. Wir kümmern uns mit einigen der besten Anlageexperten der Welt von Anfang bis Ende um Ihre Geldanlage - mit dem Ziel Ihr Geld langfristig zu vermehren. Investition in die richtigen Anlagen.

Subject at all times to Fidelitys right to alter or waive these eligibility criteria at its sole discretion you are eligible to enroll in the Rewards Program if you have 250000 Minimum Program Balance or more held in Fidelity Wealth Services andor a Fidelity Strategic Disciplines accounts Eligible Accounts registered individually in your name and Social Security. Get easy-to-use tools and the latest professional insights from our team of specialists. SoFi doesnt charge any management fee at all.

To access the firms premium private wealth services which offer enhanced investment management andor financial planning clients typically must invest a minimum of 2 million and have at least 10 million in investable assets. Fidelity GOs management fee is 035 on balances larger than 35000. From complex wealth management to your retirement needs we can help you with financial planning.

Taxable traditional and Roth IRA 529 college savings accounts. Fidelity Wealth Services Fee Only a portion of our total assets are being managed by Fidelity to meet the fee. These are traditional human investment advisors that will manage your investments on a one-to-one basis.

For our total assets Fidelity needed enough assets to be assigned to the managed accounts so that the annual fee paid quarterly equaled 5000 per year at the built in rate. Services offered by Fidelity. To qualify for a Fidelity Wealth Management account youll need at least 250000 in assets.

Fidelity Personalized Planning Advice clients must invest and maintain a minimum of 25000 in the aggregate and accounts will not be invested according to an investment strategy until an account has a balance of at least 10. Youll also pay an annual investment advisory fee that ranges from 005 to 15.

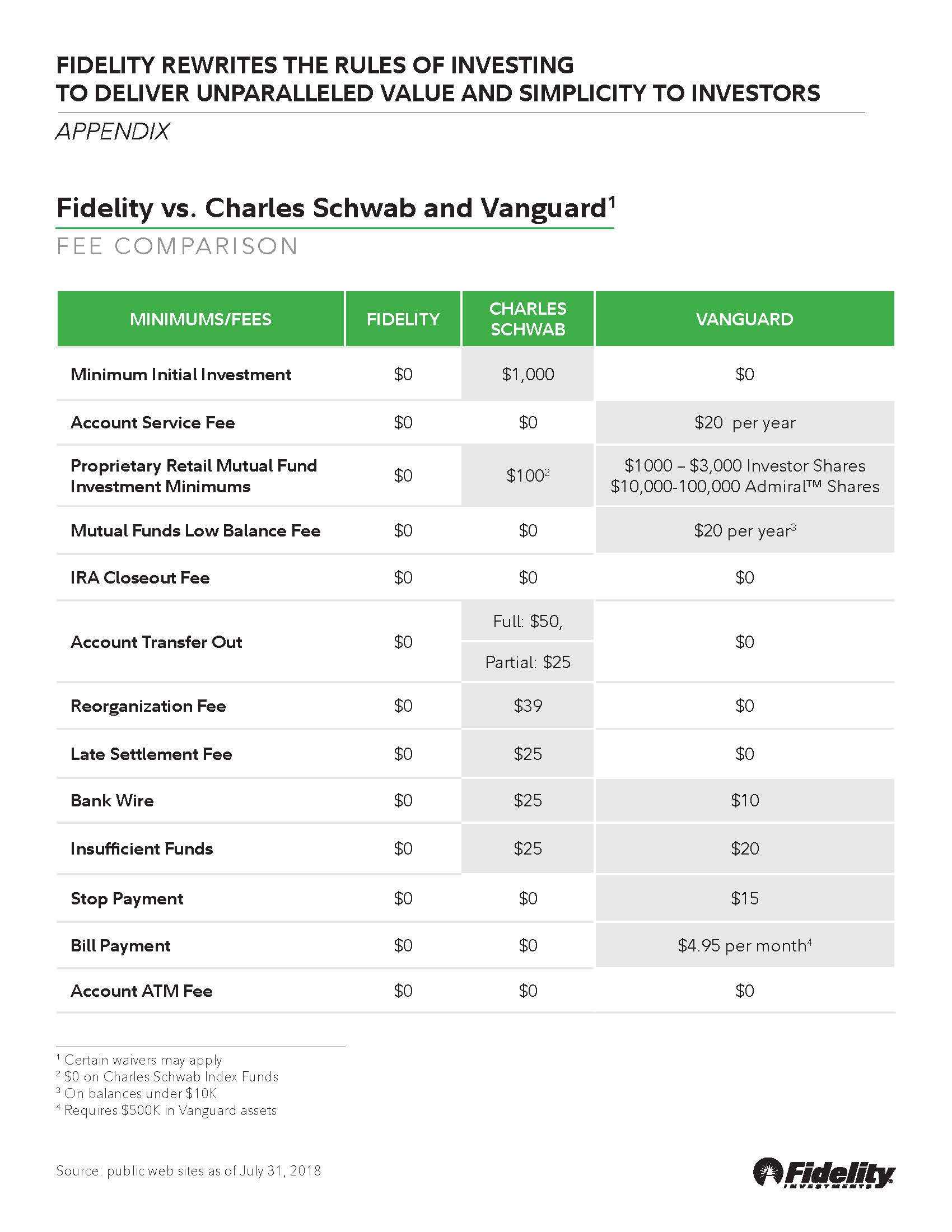

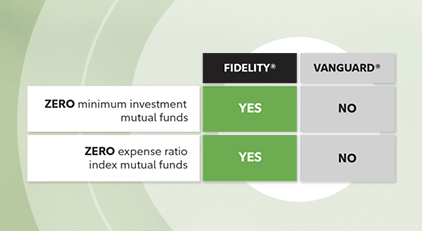

Fidelity Rewrites The Rules Of Investing To Deliver Unparalleled Value And Simplicity To Investors Business Wire

Fidelity Rewrites The Rules Of Investing To Deliver Unparalleled Value And Simplicity To Investors Business Wire

Mutual Fund Investment Ideas Fidelity

Mutual Fund Investment Ideas Fidelity

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Investments Review Self Directed Trading Managed Options

Fidelity Uses Financial Strength And Scale To Deliver Unmatched Value With First Of Its Kind Fidelity Rewards Program Business Wire

Fidelity Uses Financial Strength And Scale To Deliver Unmatched Value With First Of Its Kind Fidelity Rewards Program Business Wire

Wealth Management Wealth Planning Products And Services Fidelity

Private Wealth Management Investment Management Services Fidelity

Private Wealth Management Investment Management Services Fidelity

Seeking Shelter In Volatile Markets Fidelity

Seeking Shelter In Volatile Markets Fidelity

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

Fidelity Wealth Management 8 Points To Consider Pillarwm

Fidelity Wealth Management 8 Points To Consider Pillarwm

Fidelity Investments Review Pros Cons And Who Should Set Up An Account

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Is Fidelity Good For Beginners Is It A Good Firm To Invest With

Wealth Management Wealth Planning Products And Services Fidelity

Fidelity Cash Manager Tool Cash Management

Fidelity Cash Manager Tool Cash Management

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

Comments

Post a Comment