Featured

How Much Are Options Taxed

There are two main types of stock options. If you receive stock options talk with your tax advisor to determine how these tax rules affect you.

How Are Futures And Options Taxed

This is based on the market value of the ISOs at the time of grant.

How much are options taxed. This could possibly lead to two or perhaps more sets of tax laws governing different parts of the country. If on December 31. Exercising your non-qualified stock options triggers a tax.

This makes the issuance of stock options. If they subsequently sell back the option when. Tax treatment of options is vastly more complex than futures.

You treat the premium from writing the now-expired option as a 1500 short-term capital gain. Deductions for the Binary Options Tax In the USA you are allowed to deduct up to 3000 from the total losses. In this case the option is treated as a regular capital asset sale.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. For example if you make a profit of 15000 in options trading you are to declare taxes on the 15000 earnings. On the date that you decide to exercise your shares the stock is actually worth 30 per share.

OASDI or Social Security which is 62 on earnings up to the Social Security maximum taxable amount which is 137700 in 2020 and 142800 in 2021 HI or Medicare which is 145 on all earned income even amounts that exceed the SS taxable amount 4. For example theres an annual vesting limit of 100000 per year for incentive stock option tax treatment. The tax rules for stock options are complex.

For more information refer to Security options deduction for the disposition of shares of a Canadiancontrolled private corporation Paragraph 1101d1. The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including any amount paid for the rights to acquire the shares or. If you lose 15000 you can deduct 3000 and the rest of the 12000 will be rolled over to the future years.

In that case you have to pay income tax at your ordinary income tax rate. For example in February of this year Bob bought a contract worth 20000. Tax Treatment of Futures.

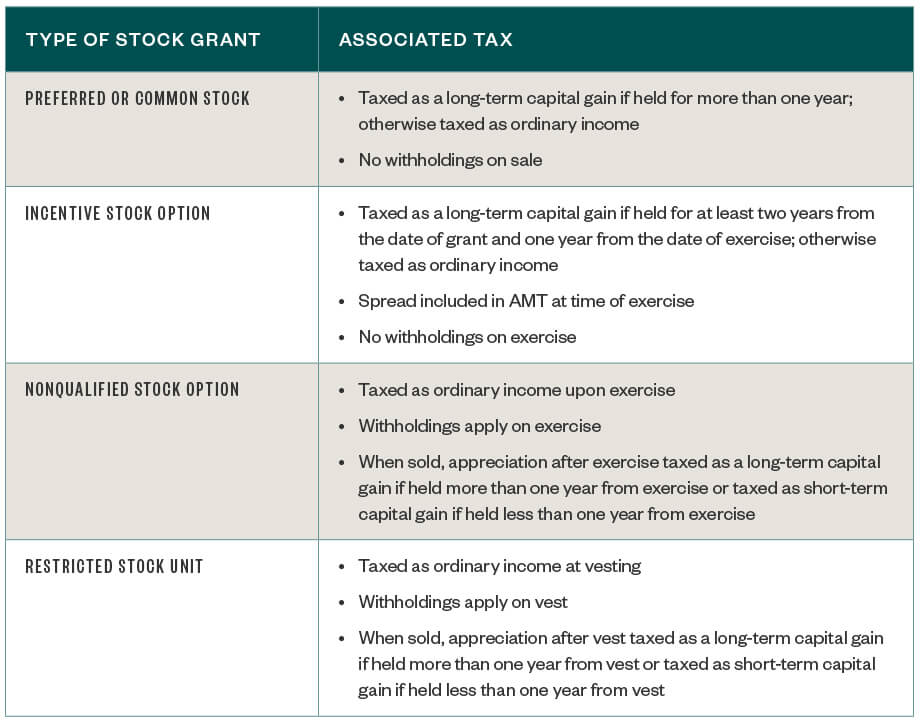

Whether that income is considered a capital gain or ordinary income can affect how much tax you owe when you exercise your stock options. The Ninth Circuit Court ruled that companies with cost sharing agreements do have to pay income tax when they issue stock options to employees. Tax Treatment of Options.

Taxes for Non-Qualified Stock Options. Long-term capital gains on assets held for at least a year are taxed at 0 15 or 20 percent depending on your annual income. In options trading the simplest tax situation occurs when the option expires unused.

One benefit index options have over individual stock options is the IRS treats them as Section 1256 Contracts named for the section of the IRS Code that describes how investments like some options must be reported and taxed. If the option doesnt meet the requirements of an incentive stock option then its taxed as a nonqualified stock option. Also taxes may change depending on what happens to stock options during a merger or acquisition.

Though there are exceptions most individual stock options we trade will be taxed 100 at your short-term tax rate as ordinary income. Option writers have a cost basis of zero and a sales price equal to the premium value plus any fees. This means that even if the value of the company skyrockets youll still be able to buy your shares at the price they were at when you were given the options.

How Are Futures and Options Taxed. Fortunately for you the stock soars to 35 and the holder wisely allows the option to expire. If you sell immediately you are paying 20000 for something that is.

Companies outside the Ninth Circuits jurisdiction may argue the Tax Courts decision applies to them and they should not recognize income when they issue stock options. In some cases the determination of a short-. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3.

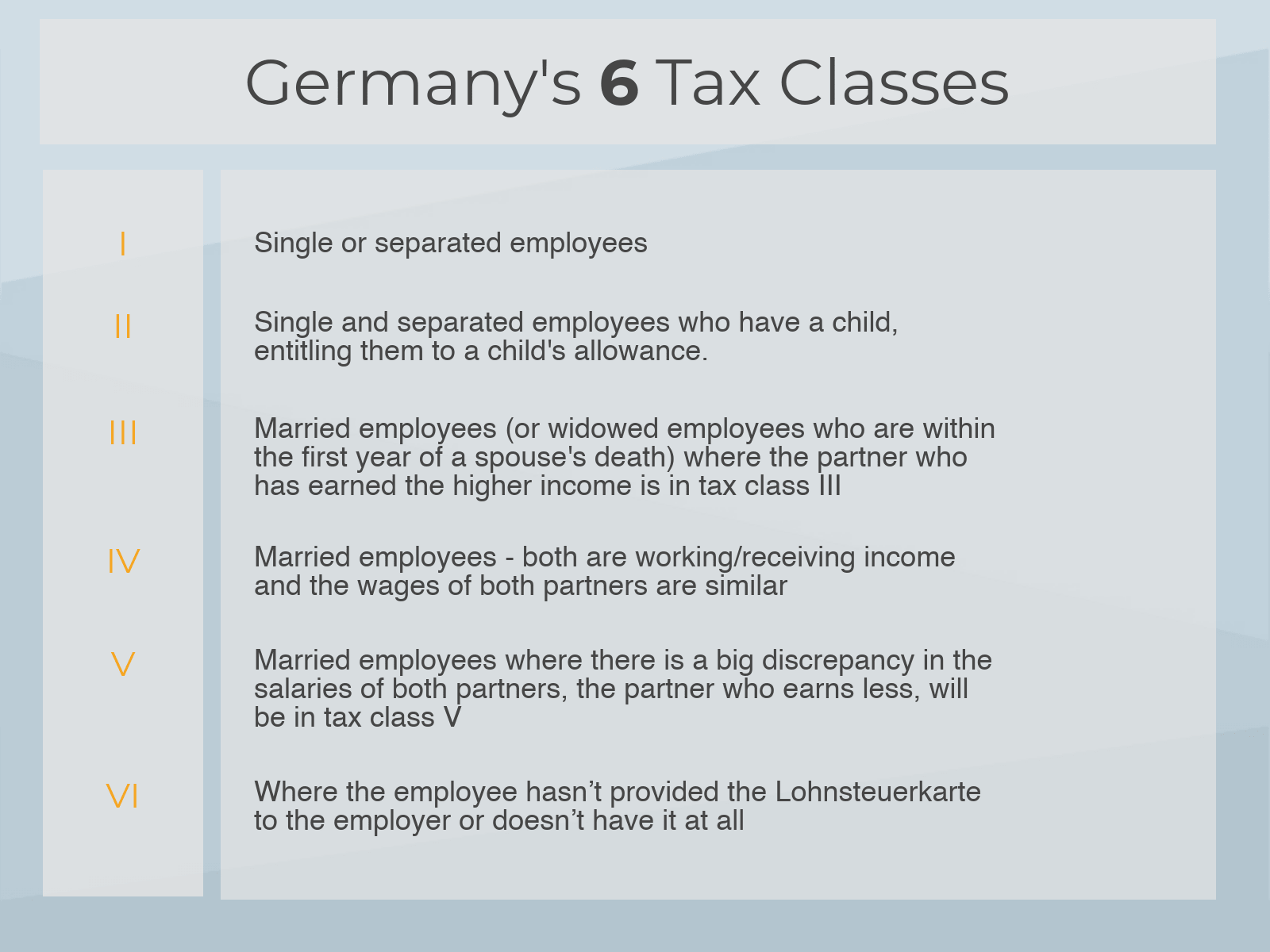

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-9b5dfea250a14cd9902b1d3406e185b2.jpg) Employee Stock Option Eso Definition

Employee Stock Option Eso Definition

Equity 101 How Stock Options Are Taxed Carta

Equity 101 How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg) Get The Most Out Of Employee Stock Options

Get The Most Out Of Employee Stock Options

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

Tax Alert Beware Of Double Taxation On Employee Stock Options Legacy Financial Group

1 Tax Rate On Stock Options In 12 Countries Percent Download Table

1 Tax Rate On Stock Options In 12 Countries Percent Download Table

Tax Planning For Stock Options

Tax Planning For Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg) Employee Stock Option Eso Definition

Employee Stock Option Eso Definition

Exercising Stock Options Everything You Should Know Carta

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium

Equity 101 How Stock Options Are Taxed Carta

Equity 101 How Stock Options Are Taxed Carta

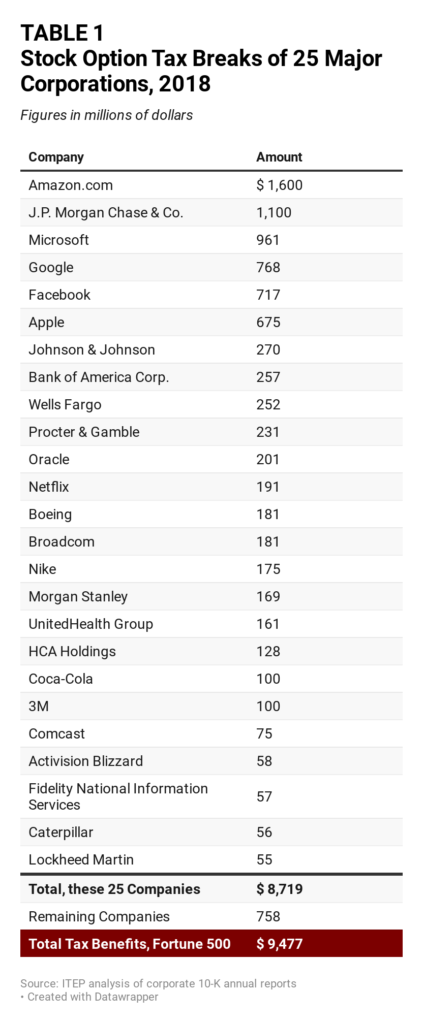

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

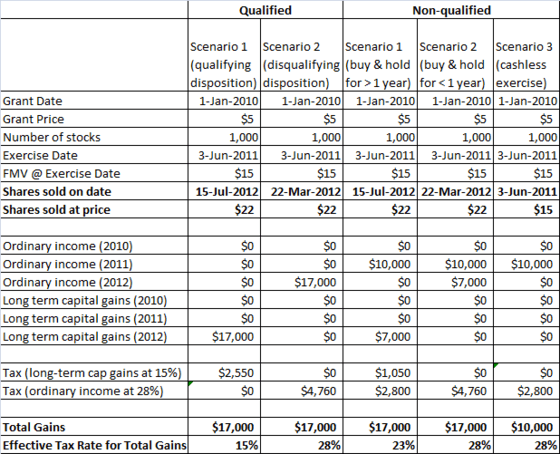

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Comments

Post a Comment