Featured

Personal Loan Market

More than half of borrowers take out a personal loan to consolidate debt or refinance credit cards. Use Content Marketing to Provide Helpful Information.

Personal Loan Interest Rates Study Why Us Consumers Are Losing Billions Supermoney

Personal Loan Interest Rates Study Why Us Consumers Are Losing Billions Supermoney

Personal loan terms typically dont exceed seven years although they can be longer in some cases.

Personal loan market. The Indian Personal Loan Market is expected to grow at a formidable rate of around 10 during the forecast period. A description of the main segments of entities operating in the market and pointing out their chief characteristics. Subprime origin Read more.

Personal loans represent about 1 of outstanding consumer debt. Segmentation by product type. The average size of a new personal loan is 6092.

Over the years weve learned a few lessons. 8 Personal Loan Marketing Ideas 1. The personal loan market.

There are more than two-billion people running around with smartphones. 202M Americans have unsecured personal loans as of 3Q19 with 156B in outstanding balances thanks in large part to QE LendingClub and Prosper. According to this study over the next five years the Personal Loans market will register a xx CAGR in terms of revenue the global market size will reach US xx million by 2024 from US xx million in 2019.

A personal loan is a loan that does not require collateral or security and is offered with minimal documentation. There are two types of personal loans secured and unsecured. The growth rate of new loan originations is stagnating.

The personal loan market has blown up in the last ten years. The UK personal loans industry contributes around 23 billion into the UK economy every year. A profile of the average customer of a personal loan company.

You should use content marketing to bring in more business. First personal loans have fixed terms that are usually relatively short. A year ago it stood at 6382.

The UK personal loans market. Advertentie Vind de laagste rentestandaard en kies de meest geschikte leningen. A personal loan is a good way to get the extra funds you need.

Selected aspects of the lending practices applied by companies from selected segments with reference to current. In 2018 the number of personal loan accounts rose to 195 million. The increasing gap income and expenditure coupled.

And unlike credit cards they have fixed payments for a specific period of time. Breakdown data from 2014 to 2019 and forecast to 2024. There are two types of personal loans.

Household expenses debt consolidation and medical expenses are the main reasons consumers get a personal loan. A personal loan is borrowed from a bank credit union or online lender that you pay back in fixed monthly payments or installments typically over two to five years. That is money that is helping to fuel economic growth in communities right across Britain.

Be Sure to Optimize Your Website for Mobile. The major players operating in the Indian Personal Loan Market are IDFC First Bank HDFC Bank ICICI Bank TATA Capital Kotak Mahindra Bank IndusInd Bank Fullerton India Bajaj FinServ SBI. Most banks and building societies offer personal loans up to 25000.

Repayments are usually spread over a period of between 1 and 10 years depending on your personal circumstances. Personal loans have fixed terms. There are several reasons why taking out a personal loan to invest in the stock market is a bad idea.

An increase of 125 from 2017 source. The consumer lending market is a favorite source of credit for millions of consumers and its growing. In comparison outstanding credit card debt is about 810 billion comprising 6 of outstanding debt.

A personal loan lets you borrow a fixed amount of money over a fixed term usually at a fixed rate of interest. Secured loans generally offer lower interest rates than unsecured loans but you must put up something for collateral like your house your car or your boat. Heres a quick summary of what we know about the personal loans market.

Advertentie Vind de laagste rentestandaard en kies de meest geschikte leningen. Secured and unsecured loans. Over the last 10 years investors funneled many billions of dollars into the personal loan market.

Personal Loans market by product type application key companies and key regions.

Personal Loans Are Now 28 Of Total Bank Credit Times Of India

Personal Loans Are Now 28 Of Total Bank Credit Times Of India

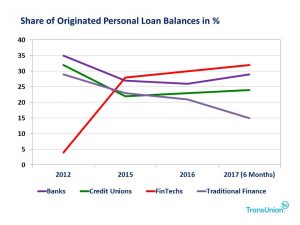

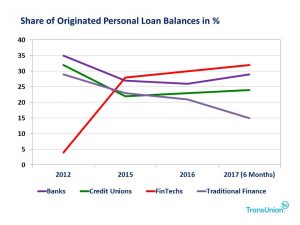

Fintech Now 38 Pct Of Personal Loan Market Pymnts Com

Fintech Now 38 Pct Of Personal Loan Market Pymnts Com

Fintechs Taking Larger Share Of Personal Loan Market While Increasing Portfolio Risk Return Performance Biia Com Business Information Industry Association

Fintechs Taking Larger Share Of Personal Loan Market While Increasing Portfolio Risk Return Performance Biia Com Business Information Industry Association

Cash Loan Personal Loan Market App 1 9 4 Telecharger Apk Android Aptoide

Cash Loan Personal Loan Market App 1 9 4 Telecharger Apk Android Aptoide

2021 Personal Loans Industry Study Supermoney

2021 Personal Loans Industry Study Supermoney

The Rise Of Online Lenders For Personal Loans Is Outstripping Traditional Banks Business Insider

The Rise Of Online Lenders For Personal Loans Is Outstripping Traditional Banks Business Insider

Fintechs Taking Larger Share Of Personal Loan Market While Increasing Portfolio Risk Return Performance Biia Com Business Information Industry Association

Fintechs Taking Larger Share Of Personal Loan Market While Increasing Portfolio Risk Return Performance Biia Com Business Information Industry Association

Personal Loan Marketplace Study A Sweet Way To Pay

Personal Loan Marketplace Study A Sweet Way To Pay

Https Www Techsciresearch Com Report India Personal Loan Market 4236 Html

Personal Loans Vs Credit Cards There Is Plenty Of Room For Growth Lending Times

Personal Loans Vs Credit Cards There Is Plenty Of Room For Growth Lending Times

Bruno Diniz On Twitter Fintech Companies Now Make Up 38 Percent Of The Personal Loan Market In The Us Up From Just 5 Percent Five Years Ago According To New Data

Bruno Diniz On Twitter Fintech Companies Now Make Up 38 Percent Of The Personal Loan Market In The Us Up From Just 5 Percent Five Years Ago According To New Data

Chart Growth In U S Personal Loan Market Driven By Fintech Statista

Https Www Techsciresearch Com Report India Personal Loan Market 4236 Html

Fintechs Continue To Drive Personal Loan Growth

Fintechs Continue To Drive Personal Loan Growth

Comments

Post a Comment