Featured

Do You Get Taxed On Stocks

When you sell investments like stocks you may owe taxes on your gains. Do note there are alternative charges attached to stocks and shares ISAs.

How To Avoid Capital Gains Tax On Stocks I Just Did It And You Could Too The Motley Fool

How To Avoid Capital Gains Tax On Stocks I Just Did It And You Could Too The Motley Fool

When Do You Pay Taxes on Stocks.

Do you get taxed on stocks. Selling stocks will have consequences for your tax bill. One of the best tax breaks in investing is that no matter how big a paper profit you have on a stock you own you dont have to pay taxes until you actually sell your shares. At the same time you also get to deduct the full market-value of the donation from your income taxes just as you normally would with a cash donation.

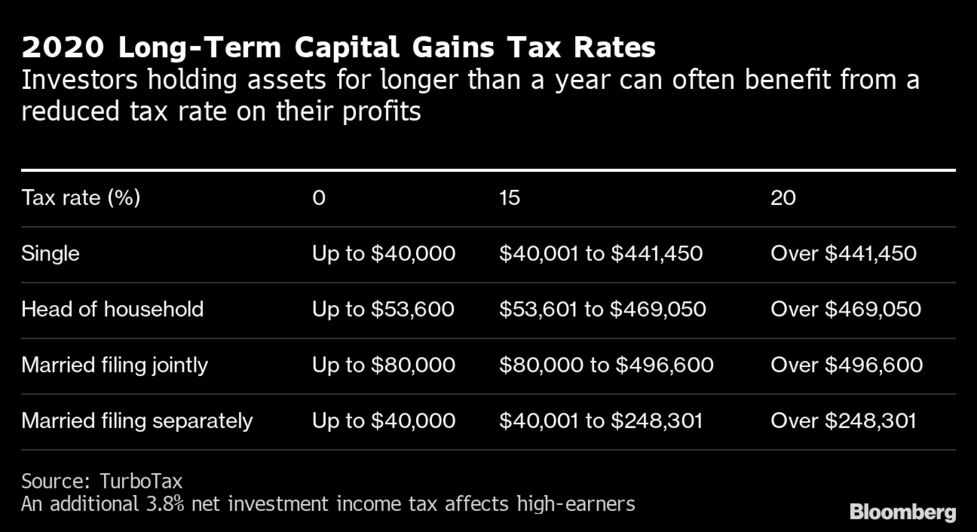

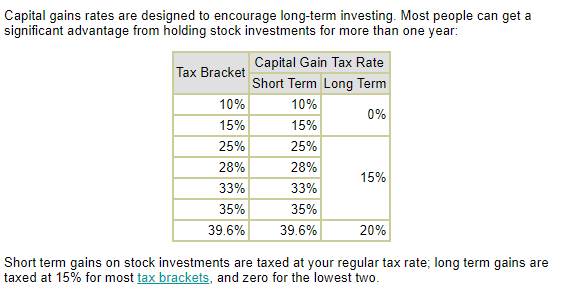

If you hold stock securities. If theyve owned the stock for a. Capital gains taxes apply when you sell a stock or other assets and they are generally lower than your regular tax rate.

Nor do you pay any income tax on interest from corporate bonds. Once you do though. This is called a capital gain.

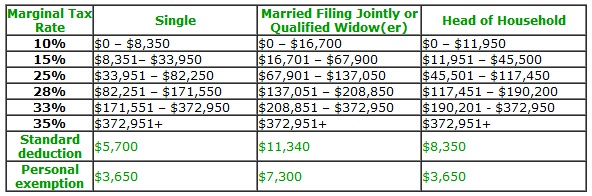

Your taxable income is the market. If You Buy or Sell Your Investments. How are stocks taxed.

If you sold stocks at a loss you might get to write off up to 3000. First there are two different ways your stock gains may be taxed. Best case scenario you have to repay the money.

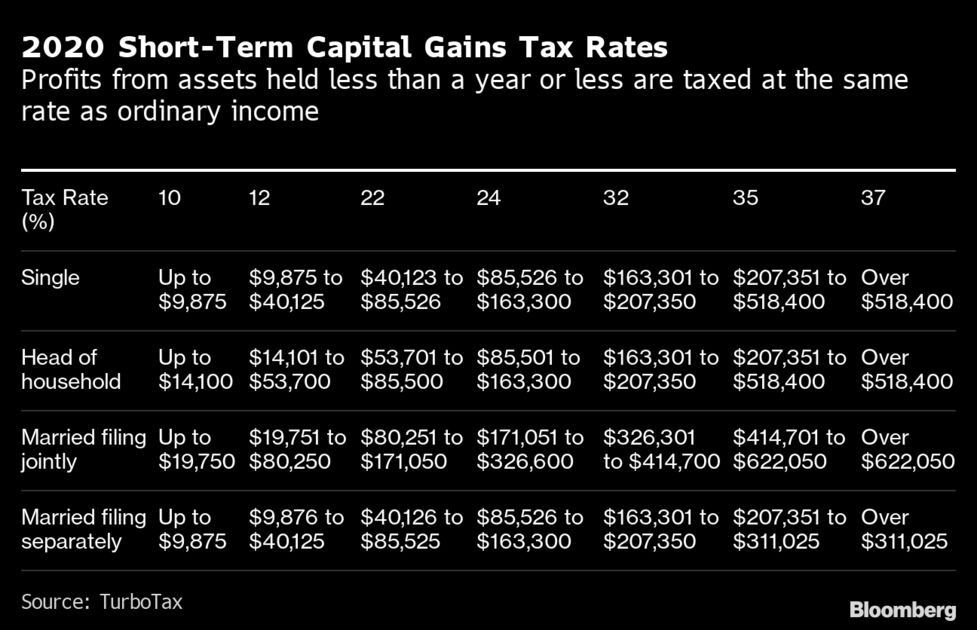

You owe capital gains taxes when you sell a stock holding for more than you paid for it and they are based on the amount you earned on that sale. If you play the stock market its important to know the taxability of your securities transactions. Once you have identified which of the brackets detailed below your trading activity falls into you are required to pay taxes on your generated income by the end of the tax year December 31st.

As shares are compensation from the company you pay taxes when you receive the stocks. Taxpayers have to recognize all of their capital gains. Theyre called capital gains taxesand when you choose to sell can have a big impact on how much tax you end up paying to.

If you netted a capital loss you might be able to use the loss to reduce your income for the year. If your stock pays a dividend. If you sold stocks at a profit you will owe taxes on gains from your stocks.

If you sell some of your investments at a gain you will have to pay taxes on the profits you made. Shares and investments you may need to pay tax on include. You generally pay taxes on stock gains in value when you sell the stock.

Shares that are not in an ISA or PEP units in a unit trust certain bonds not including Premium Bonds and Qualifying Corporate Bonds. No such provisions apply to sales of stock in taxable accounts. According to Schwab With RSUs you are taxed when you receive the shares.

However late and non-payments can result in serious consequences. Depending on the platform you use to invest you will be charged either a flat fee or a percentage of the value of your funds. Some of the rules can make your eyes glaze over but heres an easy guide on what you should know.

If a stock pays dividends you generally must pay taxes on the dividends as you receive them. For example if you sold a stock for a 10000 profit this year and sold another at a 4000 loss youll be taxed on capital gains of 6000. When you own stocks outside of tax-sheltered retirement accounts such as IRAs or 401 ks there are two ways you might get hit with a tax bill.

If you do the math your stock donation is actually worth 15-20 more than if you sold the stock. If you netted a capital gainbecause your stock transaction or transactions resulted in your making a profityou will owe capital gains tax.

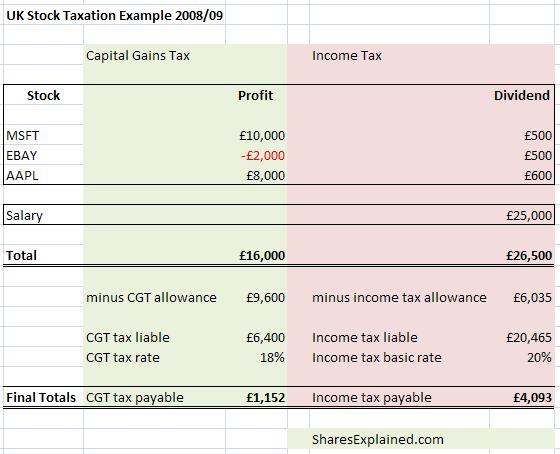

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Understanding The Tax Implications Of Stock Trading Ally

Understanding The Tax Implications Of Stock Trading Ally

How Much Tax Do You Pay On Your Equity Investment

How Much Tax Do You Pay On Your Equity Investment

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Tax On Stocks The Saving Truth Revealed

Tax On Stocks The Saving Truth Revealed

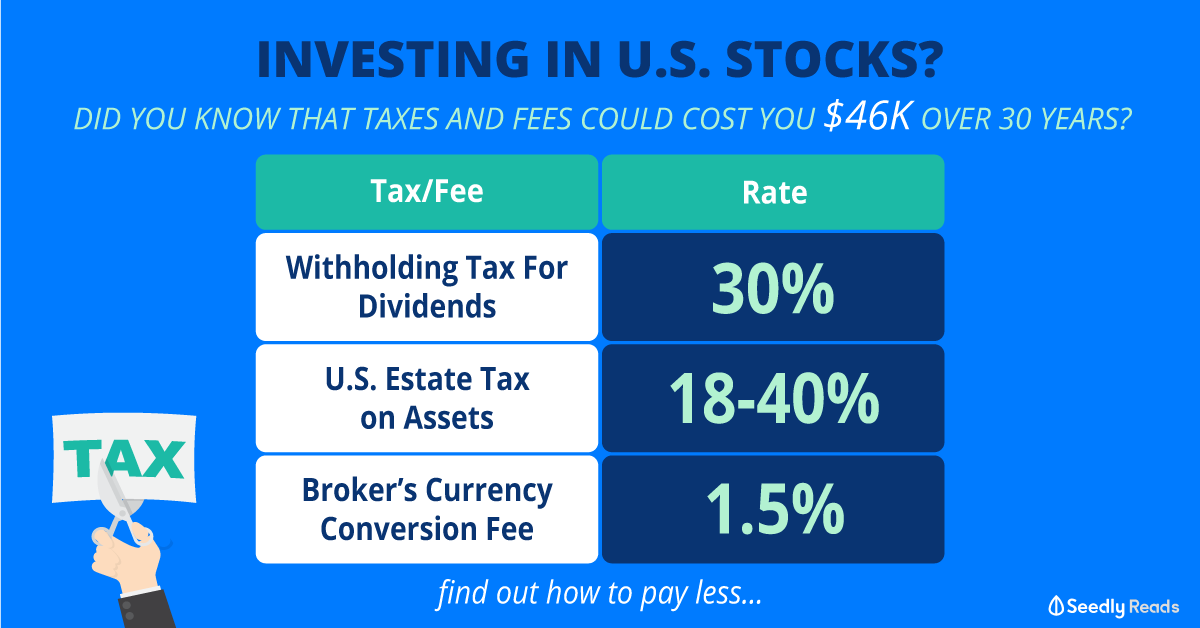

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

Definitive U S Stock Investing Taxes And Fees Guide For Singaporean Investors

Taxes On Stocks How Do They Work Forbes Advisor

Taxes On Stocks How Do They Work Forbes Advisor

Tax On Stocks And Shares Yorkshire Accountancy

Tax On Stocks And Shares Yorkshire Accountancy

How Much Are You Taxed On Stock Gains Tax Walls

How Much Are You Taxed On Stock Gains Tax Walls

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Comments

Post a Comment