Featured

How Islamic Finance Works

Conventional financing profits by charging interest on the loan meaning. How does Islamic financing work.

Diminishing Musharakah In Islamic Banking For Shariah Mortgage Aims Lecture Youtube

Diminishing Musharakah In Islamic Banking For Shariah Mortgage Aims Lecture Youtube

Listed below are Shariahs main objectives that help the Islamic scholars determine the prohibition or permissibility of any matter.

How islamic finance works. Islamic finance is a way to manage money that keeps within the moral principles of Islam. Personal loans from Islamic banks in Malaysia are based by utilising the concept of Bai Al-Inah. As an Islamic bank Al Rayan Banks products exclude the use of interest which is forbidden in Islam.

How Islamic Home Financing Works Islamic Home Financing vs. Basis of Islamic Banking Shariah and its Objectives. It covers things like saving investing and borrowing to buy a home.

1- In Islamic finance one must work for profits and simply lending money to someone who needs it does not count as work. In other words the parties collaborate on a venture and share realized profits or split suffered losses. Establishment of justice.

Islamic banking or finance is any banking or financial activity that follows the principles of Shariah a code of conduct that guides Muslims in economic social and political matters. How Does Islamic Banking Work. The term Islamic finance is used to refer to financial activities conforming to Islamic Law Sharia.

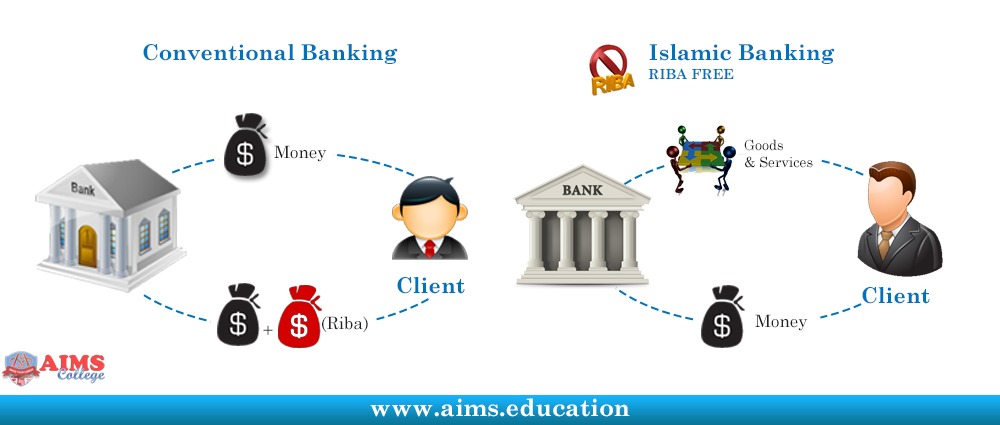

Islamic finance is principally based on trading therefore banks can profit from the buying and selling of Shariah-compliant goods and services. Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia or Islamic law. So you may hear Islamic financial services described as Islamic finance or Shariah-compliant.

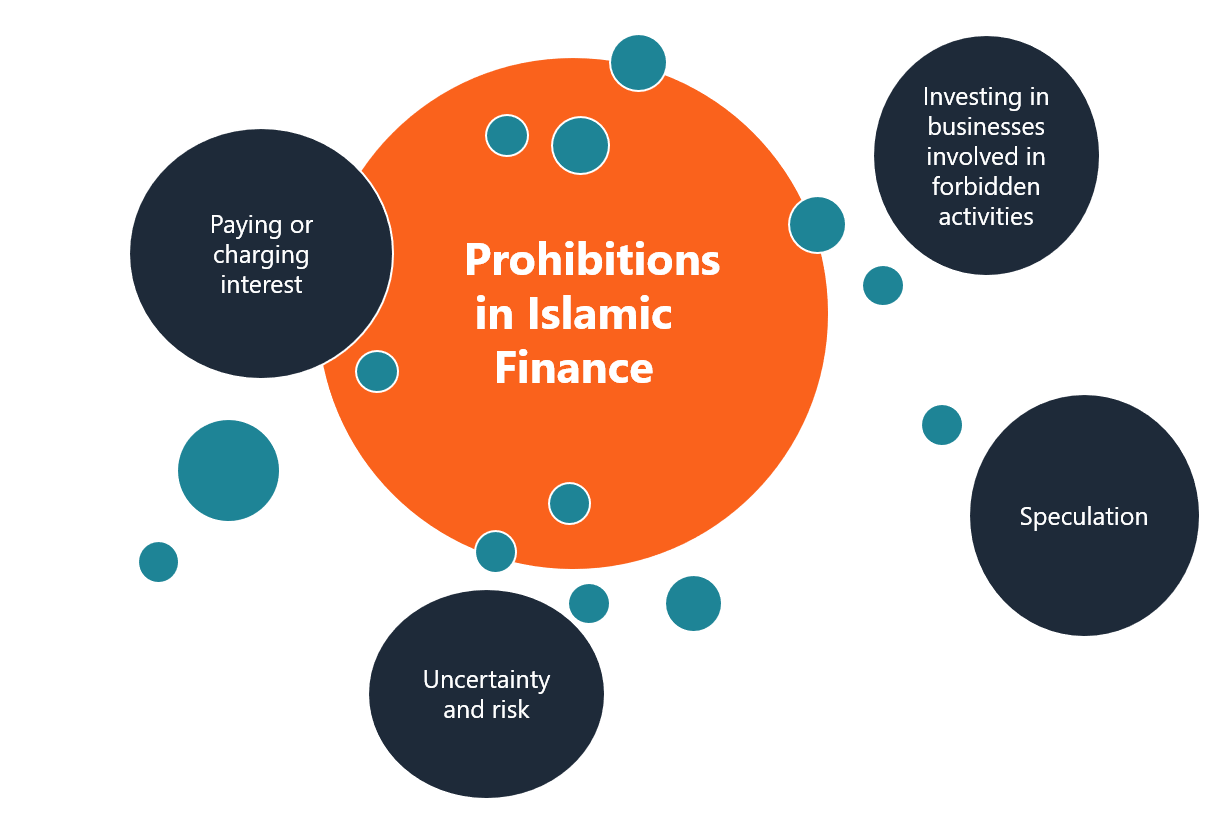

Instead We offer an expected profit rate for savings. One of the main principles of the Islamic finance system is the prohibition of the payment and the receipt of riba interest in a financial transaction. When customers deposit money the banks select Shariah-compliant investments then profits and risks are shared with the bank equally.

Islamic Finance is based on the Profit Loss sharing principle. Instead a bank must provide some service to earn its profits. To begin with in Islamic finance one must work for profits and simply lending money to someone who needs it does not count as work.

Here are some of the key sharia-compliant products offered by banks they have Arabic names but in most cases we can find an equivalent in conventional Western banking. In a nutshell Islamic banking is a system that follows Islamic Laws Shariah principles and Islamic-based economics. Islamic banks work like conventional banks except they have to obey specific Islamic principles.

Islamic banking and finance rely on the rules and regulations defined by Shariah. Islamic principles dictate that money lending interest-based as well as investing in businesses that are considered haram unlawful are prohibited. The moral principles many Muslims live their lives by are sometimes known as the Shariah.

The Islamic financial model works on the basis of risk sharing. How Does An Islamic Personal Loan Work. The home buyer borrows money to buy a home agreeing to pay it back over a period of time with added interest.

It is a concept widely used by Islamic financial institutions for personal financing which is a commonly used term in Islamic banking instead of the term personal loan as per conventional banks. I wanted to understand that how Islamic Financial system works and I found Certified Islamic Finance Expert. CIFE is an excellent program that covers all the important topics one need to understand the complete Islamic Banking and Insurance system.

The customer and the bank share the risk of any investment on agreed terms and divide any profits between them. At the heart of a traditional mortgage loan is the practice of lending and borrowing money at interest. In our book Understanding Islamic Financial Services published by Kogan Page London we discuss in detail the background of Islamic financial services shariah its sources the principles of Islamic financial service key shariah prohibitions such as interest riba and excessive uncertainty gharar and ethics in Islamic finance.

It has given insight into the Islamic Finance and developing techniques required to further strengthen this field Junaid Akhtar Abbasi. The Book also presents a comprehensive review of current. Shariah is the law based on the teachings of the Quran and Sunnah.

Aside from the absence of interest rates the key concept of Islamic finance is risk sharing between parties in all operations. Under Islamic law money must not be allowed to create more money. It also refers to the types of investments that are permissible under this form of.

Islamic Finance Principles And Types Of Islamic Finance

Islamic Finance Principles And Types Of Islamic Finance

Islamic Finance And Social Justice A Reappraisal Muslims4peace

Islamic Finance And Social Justice A Reappraisal Muslims4peace

7 Major Principles Of Islamic Banking And Finance Aims Uk Youtube

7 Major Principles Of Islamic Banking And Finance Aims Uk Youtube

Financial Crisis And Islamic Finance Reasons Of Resilience Aims Uk Youtube

Financial Crisis And Islamic Finance Reasons Of Resilience Aims Uk Youtube

Islamic Finance Rating For All Fsps Engaged In Islamic Finance Mfr

Islamic Finance Rating For All Fsps Engaged In Islamic Finance Mfr

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

Islamic Banking Glopinion Glbrain Com

Islamic Banking Glopinion Glbrain Com

How Islamic Finance Works Islamic Finance Podcast

How Islamic Finance Works Islamic Finance Podcast

How Islamic Finance Works Islamic Finance Podcast

How Islamic Finance Works Islamic Finance Podcast

Riba In Islamic Banking And Finance Its Types Aims Lecture

Riba In Islamic Banking And Finance Its Types Aims Lecture

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

What Is Islamic Banking And How Does Islamic Banking Work Vblog Aims Uk Youtube

How Does Islamic Finance Work Youtube

How Does Islamic Finance Work Youtube

Figure The Working Transaction Of Salam Financing The Figure Depicts Download Scientific Diagram

Figure The Working Transaction Of Salam Financing The Figure Depicts Download Scientific Diagram

/PROJECT-DEVELOPER-9bddde300c994be3871dd9790d15f7bb.jpg)

Comments

Post a Comment