Featured

Bond Market Outlook 2020

The past year saw a significant change in policy from the US. German and French issuers lead the pack.

Outlook 2020 Emerging Market Debt Absolute Return Asset Management Schroders

Outlook 2020 Emerging Market Debt Absolute Return Asset Management Schroders

Three expert views on prospects for Chinas economy in 2020 and 2021 plus a market strategy outlook for bonds equity and multi-asset investors.

Bond market outlook 2020. Municipals wrapped up a historic 2020 with broad-market muni indexes up 425 for the year. Federal Reserve with three interest rate cuts and a significant re-expansion of their balance sheet starting in September. 2019s strong performance in global bond and credit markets was driven by declines in government bond yields.

This has been a relatively busy year for the primary market with covered bond benchmark. Given the evidence from the bond market that the economy is likely to become more sluggish there is little prospect that the Fed will raise rates in 2020. Covered bond market review and outlook for 2020 Strong primary market in 2019.

Treasuries dropped from 325 in its 2019 forecast to 270 in its 2020 forecast and from 45 for corporate bonds in 2019 to 34. Only in euro 1416 billion of which 745 by European entities and. Do you agree and what are the key risks for bond investors going in 2020.

Thats nearly double the indexs 10-year annualized return of 386. Until the start of the next cycle of Fed rate hikes I recommend de-emphasizing floating rate bond funds. The conversation touches on the economic outlook.

Joe Davis Vanguard global chief economist. In particular cyclicals and beaten-down value stocks should prosper. The policy repo rate has been reduced by cumulative 115 basis points and the reverse repo rate by 155 basis points in 2020.

Further compression in credit spreads which occurred largely in the first half of the year also boosted returns of credit markets. Second commodity prices have rallied vigorously. Bryden Teich and Paul Gardner discuss Avenues outlook for interest rates and Federal Reserve policy as we enter 2020.

In SSA field the issuance of green or sustainable bonds was very relevant in the past 3 months. Compared to 2020 when global monetary and fiscal policies were focused on supporting solvency and bond investors benefitted from flocking to safe-haven assets such as US. This year we have reduced our allocation to these funds and shifted capital into short-term corporate high yield.

Von Hayden Briscoe Bin Shi and Gian Plebani. The title of Vanguards outlook for 2020 was The New Age of Uncertainty It seems almost prophetic in retrospect. Bond market movements will act as key indicators of the health of the recovery as well as corporate performance and consumer confidence in 2021 and beyond.

Page 15 MTS 3 March 2020 Primary markets Having sovereign issuers profited of the good market moment 33 of the 2020 bond issuance programme is completed. Accelerating economic momentum in 2020 should drive bond yields up from record-low levels which should create a very strong backdrop for global equities. 10-Year T-Note finished 2019 at 187 a far cry lower than the 269 at the end of 2018.

Treasuries this year may. Its true that we were expecting heightened uncertainty this year owing to concerns about global growth unpredictable policymaking trade tensions and Brexit negotiations. Inflation and bond yields.

But in the second quarter the. However despite 2019 seeing a continuation of falling bond yields the world according to equity and corporate bond or credit investors was in relatively rude health. Indeed the firms return assumption for intermediate-term US.

Despite the damage done during an extraordinary week in March when COVID-19 cases spiked many governors shut down their states and investors sold anything they could to raise cash the Bloomberg Barclays US Aggregate Bond index which tracks the broad US bond market returned 736 as of December 11 2020. Crude oil for example is up roughly 70 from October 30 2020. In the first quarter of 2020 January to March the fund was positioned defensively as the managers believed the market was riskier than prices seemed to suggest.

Bonds equities and the economy. Among cyclicals we prefer the industrials and materials sectors as well as the energy sector. Looking at the countries Germany issuers came in just ahead of French.

First inflation pressures have naturally grown along with the recovering economy. The bond market has been on a wild ride so far in 2020. The yield on the 10-year Treasury note started the year just below 2 and recently stood at 07.

One of the consequences of the improved outlook has been rising inflation expectations and higher bond yields. Our bond market outlook was upended by the Feds 180-degree pivot on interest rate policy. The market has largely recovered from the pandemic-induced liquidity crisis that sent prices plummeting.

The economic data story has been similar take the unemployment rate for example. This was after 135 basis points reduction in the policy rates in the last. Higher inflation expectations are understandable.

Recorded on January 7 2020. Equity markets rallied strongly and credit spreads yields on corporate bonds relative to lower risk government bonds compressed to near their historically tightest levels. 2020 was a good year for bond prices and for investors who seek bonds to preserve capital.

Feg Insight 2020 Fixed Income Market Outlook

Feg Insight 2020 Fixed Income Market Outlook

Municipal Bond Market Outlook 2020

Municipal Bond Market Outlook 2020

Q2 Bond Market Outlook Looking Beyond The Coronavirus Crisis Charles Schwab Commentaries Advisor Perspectives

Q2 Bond Market Outlook Looking Beyond The Coronavirus Crisis Charles Schwab Commentaries Advisor Perspectives

Market Outlook August 2020 Sanlam

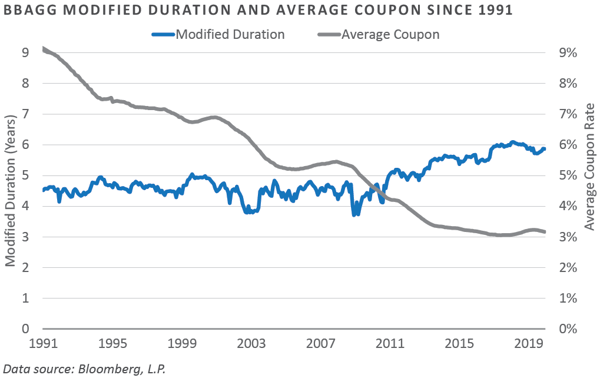

2021 Market Outlook Fixed Income

2021 Market Outlook Fixed Income

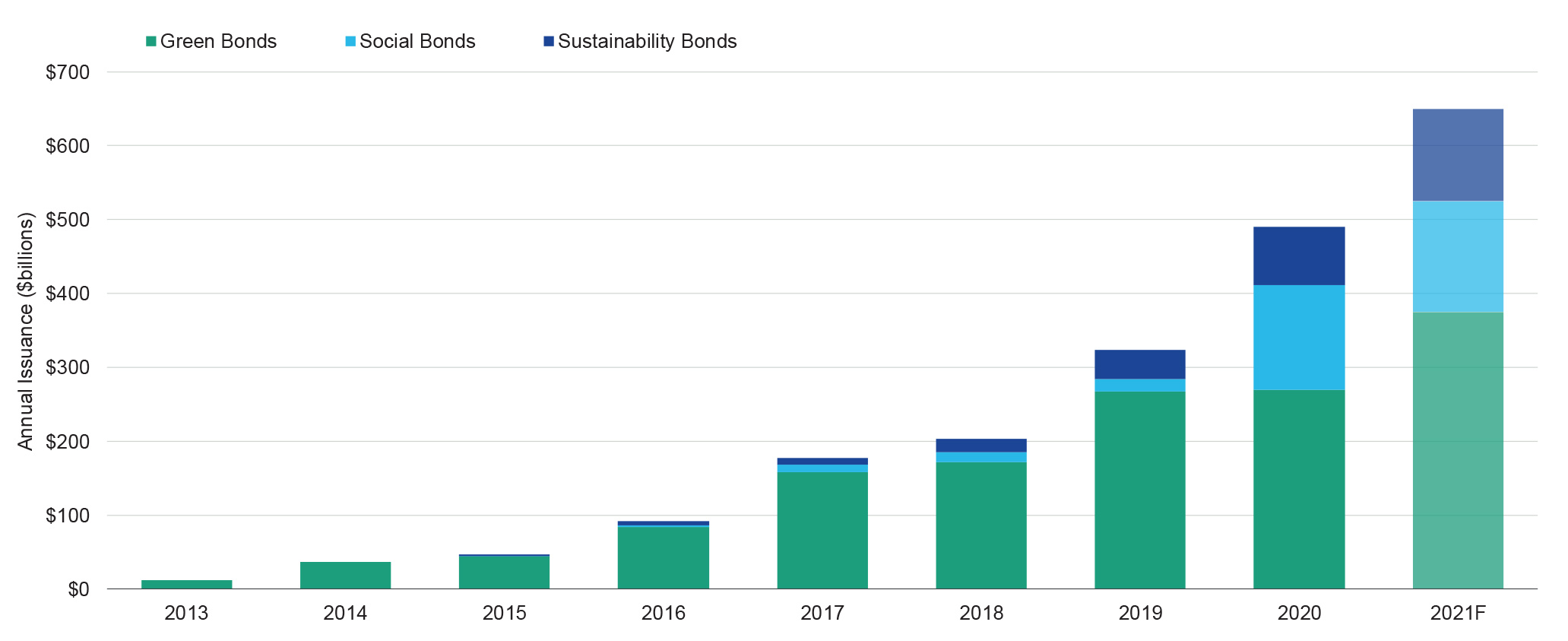

The 2020s The Decade Of Sustainable Bonds Environmental Finance

The 2020s The Decade Of Sustainable Bonds Environmental Finance

Market Outlook 2020 Global Bonds Schroders Global Schroders

Market Outlook 2020 Global Bonds Schroders Global Schroders

Trends In Sustainable Bonds Issuance And A Look Ahead To 2021 Environmental Finance

Trends In Sustainable Bonds Issuance And A Look Ahead To 2021 Environmental Finance

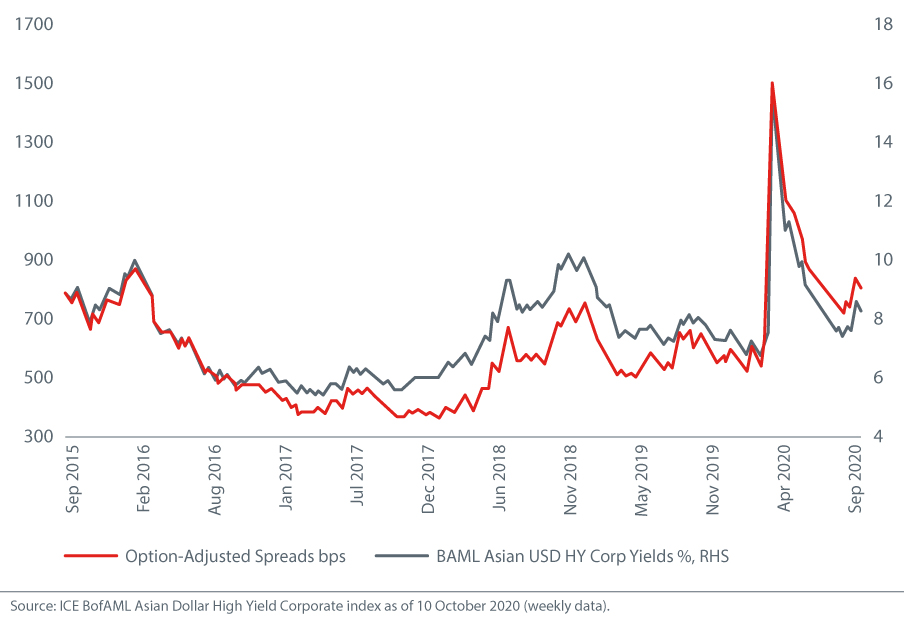

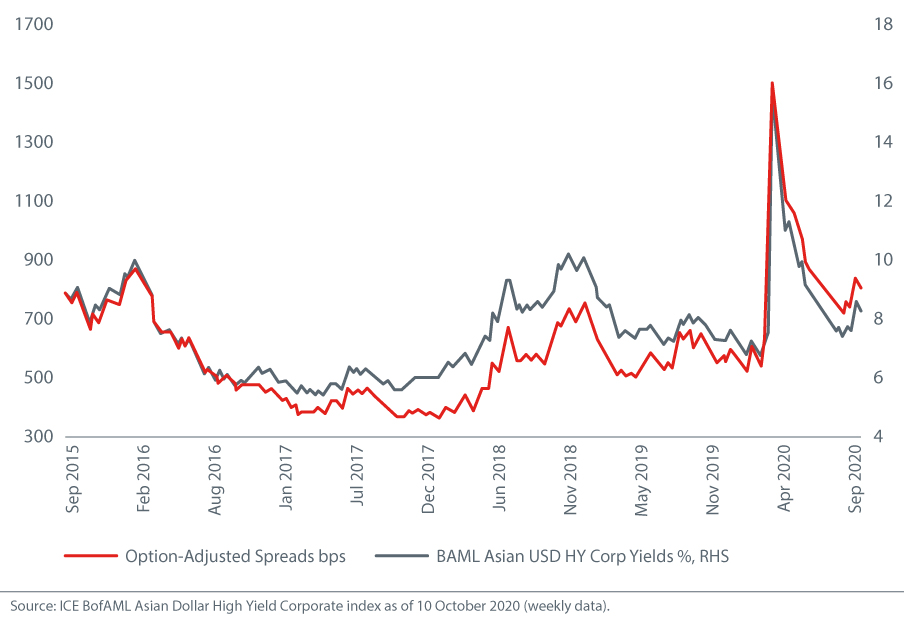

Market Outlook 2020 Asian Corporate Bonds Professionele Schroders

Market Outlook 2020 Asian Corporate Bonds Professionele Schroders

Market Outlook 2020 Global Credit Institutioneel Schroders

Market Outlook 2020 Global Credit Institutioneel Schroders

2021 Outlook European High Yield Bond Market Set To Maintain Strength S P Global Market Intelligence

2021 Outlook European High Yield Bond Market Set To Maintain Strength S P Global Market Intelligence

2020 Vision Bond Market Outlook

2020 Vision Bond Market Outlook

Comments

Post a Comment