Featured

Can I Claim Stock Losses On My Taxes

Luckily once youve determined that you qualify the process is fairly straightforward to salvage. However youre unable to convert any prior capital losses you have made as an investor into revenue losses.

How To Deduct Stock Losses From Your Taxes Bankrate

How To Deduct Stock Losses From Your Taxes Bankrate

You must sell the capital property to claim the capital gain.

Can i claim stock losses on my taxes. If your activities change from investor to trader your investment changes from a CGT asset to trading stock. When your stock trade turns ugly and its become clear you wont make money you need to consider how to claim a loss on your taxes. Can You Claim Stock Market Loses on Your Income Taxes.

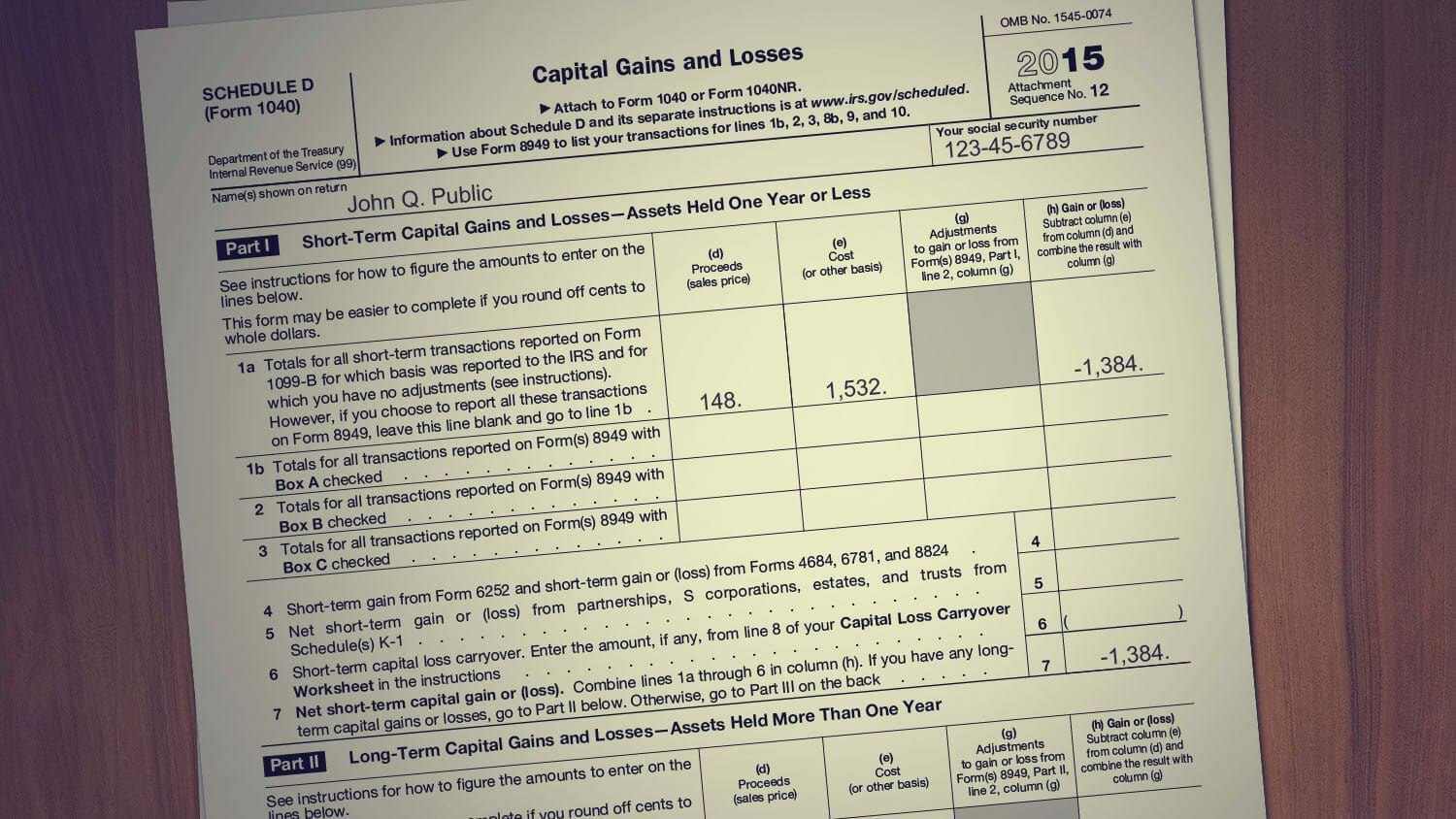

Generally you have to sell a stock to claim a capital loss so a bankrupt stock can cause problems. You can deduct a net loss of up to 3000 1500 if married filing separately. Those losses that you reaped in the previous calendar year in your taxable retail accounts can.

However you must carefully document the stocks worthless status. Capital losses and deductions. A stock sale can yield a short- or long-term gain or loss.

Luckily Uncle Sam makes taking stock losses a little easier by giving investors the opportunity to write off losses at tax time. Capital losses may be used to reduce capital gains in the year of sale any of. Bragging about stock market losses is never in style except when youre filing your tax returns.

Any capital loss you couldnt deduct this year can be carried forward and deducted on future tax returns as a capital loss carryover. Grouping Gains and Losses. This can trigger CGT event K4.

You can do this using the special arrangement that Seedrs have negotiated with SimpleTax. The loss on stocks and any other capital asset is a capital loss. Under the tax code investors can write off any amount of.

As the property sits in your portfolio it is not subject to gains or losses though it may be active in your tax situation as depreciation or capital cost allowance. June 1 2019 1001 AM To get a tax deduction for stock losses you enter a cost basis higher than the sale price. If youve been a victim of the stock markets wild ride and sold stocks at a loss.

The loss on each stock trade equals the amount you spent to buy. Its never fun to lose money in the stock market except when you file your taxes. You should continue to carry forward those capital losses.

Re-classifying from investor to trader. Stock market gains or losses do not have an impact on your taxes as long as you own the shares. This is 12 months after the deadline for submitting the tax return for that year.

Claims for losses and for relief for those losses must be made through the tax return and the time limit is the next 31 January one year after the end of the tax year of the loss. The gain or loss is short-term if. The IRS places limits on which trades qualify for claims so understanding the rules will help save some time before you start filling out tax forms.

The Internal Revenue Service recognizes this difficulty and allows you to deduct stock losses due to bankruptcy. This section provides information on capital losses and on different treatments of capital gains that may reduce your taxable income. Consult our Summary of loss application rules chart for the rules and annual deduction limit for each type of capital loss.

The wash sale rule also applies if you buy shares within 30 days before you sell them. You will still input the information in the Income Expenses portion of your tax interview. Under this rule if you buy back the same stock or other security within 30 days after the sale you cannot claim the losses on your tax return for the year.

You can only claim stock market losses on your taxes when you actually sell the stock not just because the market price went down. Your total capital gains for the year minus your total capital losses result in a net gain or a net loss. If we review your tax returns and find that you have incorrectly claimed losses you may be subject to penalties.

Can I Claim Capital Losses From A Stock In My Rrsp Moneysense

Can I Claim Capital Losses From A Stock In My Rrsp Moneysense

Reap The Benefits Of Tax Loss Harvesting

Reap The Benefits Of Tax Loss Harvesting

Can I Claim A Loss On Stock Investments

Can I Claim A Loss On Stock Investments

:max_bytes(150000):strip_icc()/taxescoins-5bfc325146e0fb00514616ad.jpg) How To Deduct Stock Losses From Your Tax Bill

How To Deduct Stock Losses From Your Tax Bill

How Do Investment Losses Affect Taxes The Motley Fool

How Do Investment Losses Affect Taxes The Motley Fool

How To Get A Nice Tax Break On Your Stock Losses

How To Get A Nice Tax Break On Your Stock Losses

Are There Limits To Stock Loss Deductions

All About The Capital Loss Tax Deduction Smartasset

All About The Capital Loss Tax Deduction Smartasset

Account For Losses In Tax Returns To Lower Tax Liability

Account For Losses In Tax Returns To Lower Tax Liability

How To Claim A Capital Losses Tax Deduction For My Investment Property Youtube

How To Claim A Capital Losses Tax Deduction For My Investment Property Youtube

How To Claim Tax Deductions For Stock Losses Investor Junkie

How To Claim Tax Deductions For Stock Losses Investor Junkie

What Is The Capital Loss Deduction The Motley Fool

What Is The Capital Loss Deduction The Motley Fool

How To Deduct Stock Losses From Your Taxes Bankrate

How To Deduct Stock Losses From Your Taxes Bankrate

Comments

Post a Comment