Featured

- Get link

- X

- Other Apps

Fisher Investments Fee Schedule

Equity and blended. 6 rows Fee Schedule for Fisher Investments Equity and Blended Accounts.

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Review 2021 The Dough Roller

Fisher Investments does not charge any commissions for trades nor do they apply any hidden fees or extra service charges.

Fisher investments fee schedule. The fee ranges between 1-15 depending on the investment. A fee of this margin is competitive in the world of investment management. The only fee you pay to Fisher is an annual management fee of 15 of your account value for accounts under 500000 this fee scales down to 1 for larger accounts.

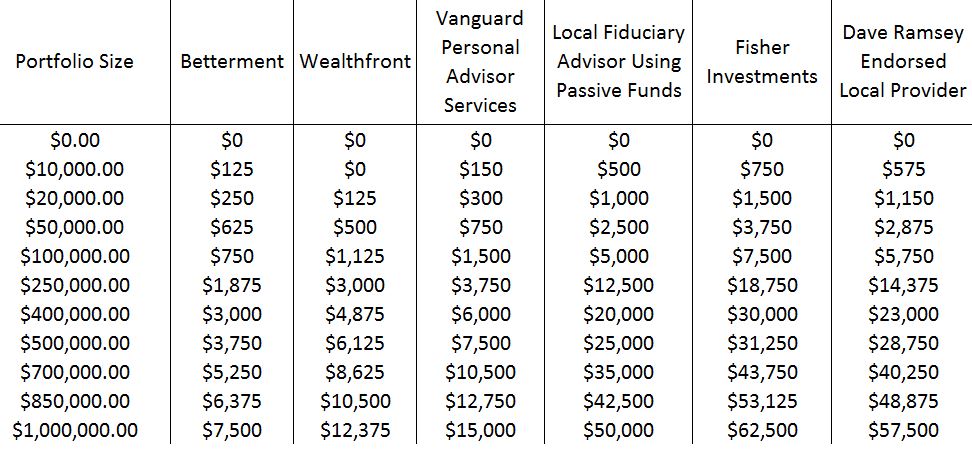

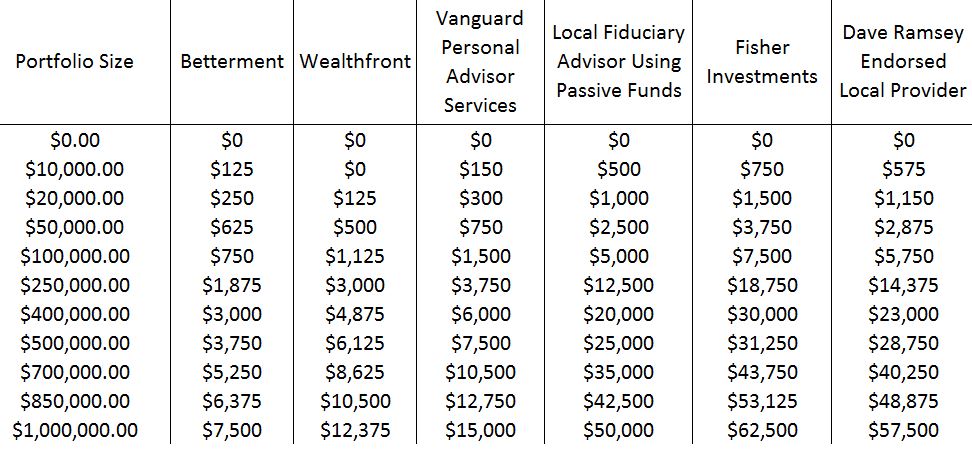

Local fiduciary advisor fee 1. At Fisher Investments we understand the issues fees raise. Fisher Investments charges an all-encompassing fee of 15 on portfolios up to 500000.

Thanks to the Tax Cuts and Jobs Act of 2017 TCJA most investment-related expenses are no longer deductible. This model projects that 70 of your returns depend on asset allocation the mix. This is because it pursues investments of mutual success.

Fisher Investments top-down approach follows a 702010 model. You agree to pay the Storage Operator within thirty 30 days of the date appearing on your. Hence we offer a simple and competitive tiered advisory fee based on your portfolios size.

The fee drops on higher account balances to as low as 125. Fisher Investments does not have a fee schedule because the firm believes the percentage charge system is better for both the firm and clients. Fidelity Investments 1997 2007 10 years.

The Ohio State University. Fisher Investments fee based on 15 charge up to 500000 in assets 125 charge above 500000 in assets. Typically balances up to 500000 are charged a 15 fee while a lower fee is charged for higher balances.

As of yesterday here are my portfolio returns compared to MSCI World Index and SP annualized. After leaving Fisher I have had questions in connection with securities litigation claim forms I received on shares. The fee is between 1 and 15 depending on the number of investments under management.

It is designed to be easy to understand and we believe it puts your interests first. Instead the firm charges a competitive fee that is based on the size of your portfolio. There are no commissions or hidden fees based.

As of Sept. Ken Fisher is wrong fund management fees are too high Ken Fisher the billionaire founder of Fisher Investments sees no problem with the level of fund management fees. Fisher Investments and its subsidiaries manage over 169 billion in assetsover 109 billion for North American private investors 40 billion for institutional investors 17 billion for European private investors and 1.

67 reviews of Fisher Investments I was a client of Fisher Investments for over 10 years paying them well over 100000 in management fees. The fees charged on Fisher Investments are lower than those of other portfolio management agencies. By basing charges on portfolio growth and value maintenance the best interests of the firm align with the interests of clients.

The Facilitys current fee schedule is attached. You will be billed for storage fees processing and other service fees associated with your Account quarterly in accordance with the Facilitys then-current fee schedule. You will also be responsible for paying any trading commissions generated in your account but these will be billed to you separately by the independent custodian Fisher pays to hold your assets.

Since I am a client of Fisher I do have my own actual returns to offer. 401k Brokerage and Mutual Fund Service Associate Fidelity Investments August 1992 1997 5 years. If you have investments you may be wondering where you can deduct investment fees on your income tax return.

However compared to robo-advisors this fee seems much higher. 1 YR 3 YR 5 YR Fisher 636 1437 1545 MSCI Wld 215 1254 1530. Please review it carefully.

Schedule a Free Consultation. I recently made a decision to follow a passive investment strategy and moved my account from Fisher which was subsequently closed. Dave Ramsey Endorsed Local Provider fee based on typical 575 mutual fund sales commission amortized over five years Looking at the above chart might shock you.

30 Fisher Investments and its subsidiaries managed a total of 112 billion of which 35 billion was managed for 175 institutional investors and other money managers according to. Top US-Based Fee-Only Registered Investment Adviser INVESTMENT NEWS 2016 - 2019. The company charges customers with a competitive advisory fee divided according to the size of the individual equity portfolio.

Fisher Investments has around 83 billion in Assets Under Management and is one of the largest wealth managers in the US. Dont spend a lot of time hunting around for the right place to enter them.

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Recognized By The Financial Times As A Top 300 Registered Investment Advisers Rias For Seventh Consecutive Year

Fisher Investments Recognized By The Financial Times As A Top 300 Registered Investment Advisers Rias For Seventh Consecutive Year

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Review 2021 The Dough Roller

Fisher Investments Review 2021 The Dough Roller

Https Www Fi Com Pdfs Fi Diff Pdf

Fisher Lost 20 Million In Retail Assets After Billionaire S Comments

Fisher Lost 20 Million In Retail Assets After Billionaire S Comments

Fisher Investments Review 2021 Investor Com

Fisher Investments Review 2021 Investor Com

Italian Investment Counsellor In Dublin Fisher Careers

Italian Investment Counsellor In Dublin Fisher Careers

Financial Advice Is A Ripoff Here S What You Should Pay

Financial Advice Is A Ripoff Here S What You Should Pay

Fisher Investments Review 2021 Personal Investment Counselors

Fisher Investments Review 2021 Personal Investment Counselors

Fisher Investments Review 2021 Wholesomewallet Get Better With Money

Fisher Investments Review 2021 Wholesomewallet Get Better With Money

Simple Fee Structure Fisher Investments

Simple Fee Structure Fisher Investments

Fisher Investments Review 2021 Personal Investment Counselors

Fisher Investments Review 2021 Personal Investment Counselors

Comments

Post a Comment