Featured

Short Spx Etf

This ETF offers 3x daily short leverage to the broad-based SP 500 Index making it a powerful tool for investors with a bearish short-term outlook for US. Employ a short-term hedging strategy to offset losses in an equity portfolio.

Etf Investors Dialed Up Risk Over Last 10 Months Etf Trends

Etf Investors Dialed Up Risk Over Last 10 Months Etf Trends

In addition to standard inverse ETFs there are leveraged inverse ETFs on SP 500 which amplify the returns by the given factor.

Short spx etf. This fund provides unleveraged inverse exposure to the daily performance of the SP 500 index. SPXS is an extremely aggressive bet against the SP 500 promising to provide -300 of the indexs return for a one-day period. Single inverse ETFs are trading tools that allow investors to either seek profit or seek to apply a hedge for an existing portfolio position that they anticipate will experience negative returns in the short term.

Traders and investors who have a bearish view on the SP 500 index but dont want to take a short position can attempt to benefit by purchasing ETF units in such inverse SP 500 ETFs. 21 реда Leveraged 3X InverseShort ETFs seek to provide three times the opposite. ProShares Short SP Regional Banking ETF KRS This fund provides unleveraged inverse exposure to the daily performance of the SP Regional Banks.

DB X TRACKERS SP 500 SHORT ETF. Investors using leveraged and inverse broad market ETFs should have a comprehensive understanding of their features benefits and risks a high risk tolerance and the ability to monitor their positions daily. Consider using them to hedge an existing portfolio as well.

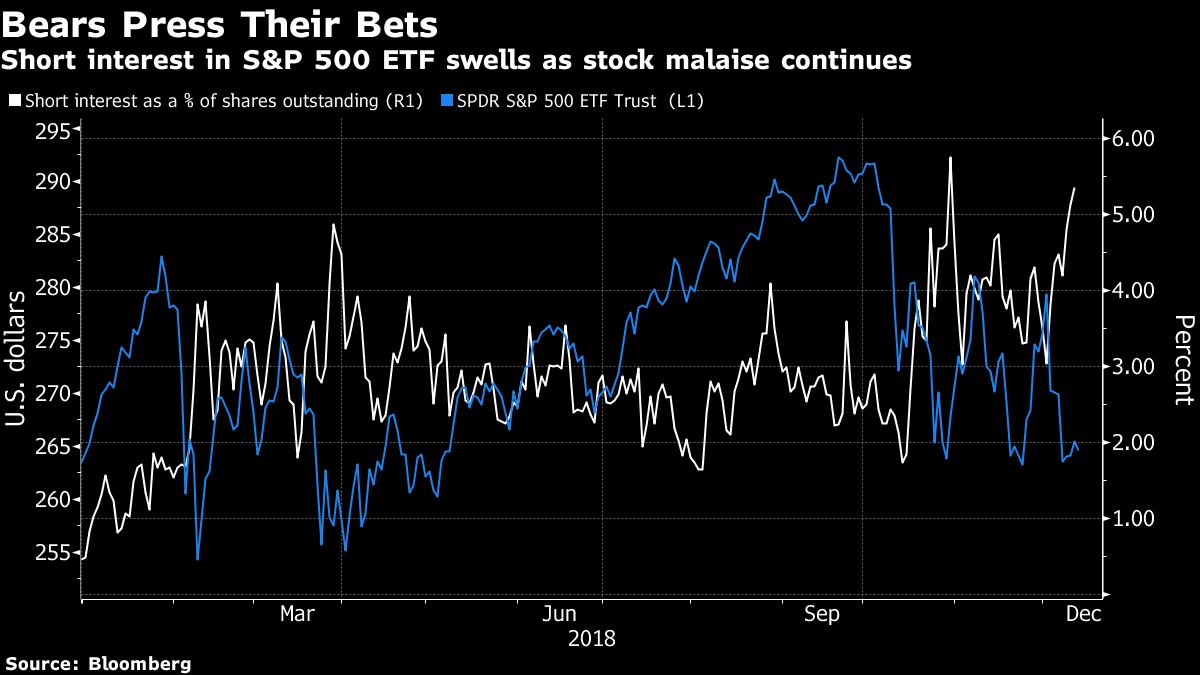

Hedge funds mutual funds and retail investors all engage in shorting the ETF either for hedging or to make a direct bet on a possible decline in the SP 500 Index. Alles zum ETF Realtime-Kurs Chart Nachrichten Marktberichte Chartanalysen und vieles mehr. It is the most popular and liquid ETF in the inverse equity.

It has accumulated 189 million in its asset base while trades in average daily volume of 34000. They trade on national stock exchanges at the prevailing market prices. SPXS Factset Analytics Insight.

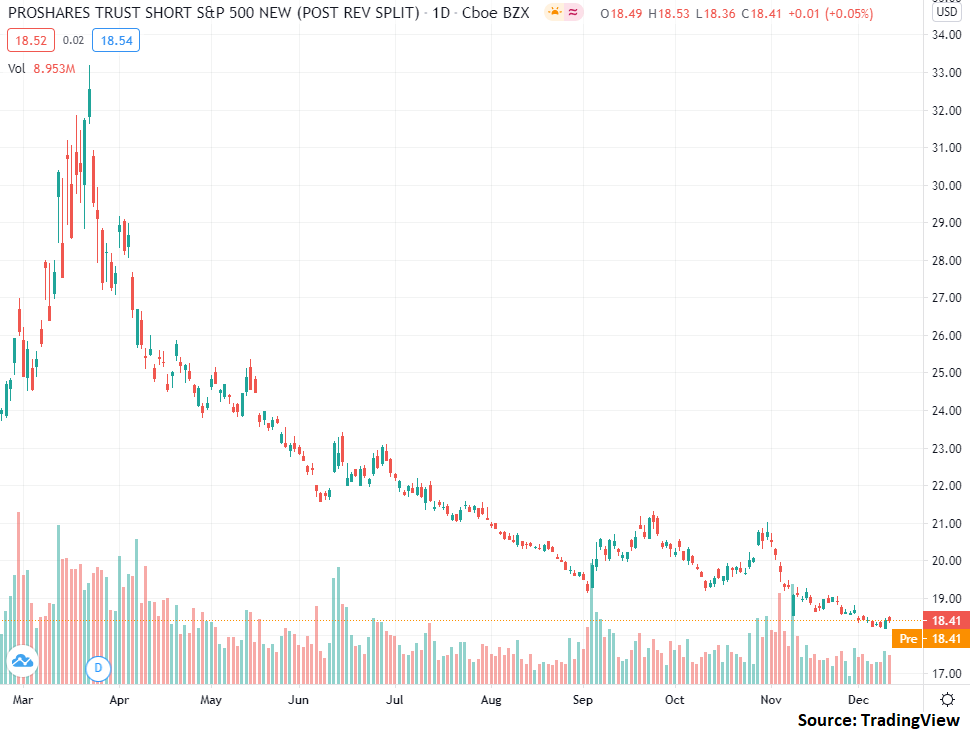

This means there is a compounding effect as the daily return will always be based on the previous days closing price. Short Mid Cap 400. The performance of single short double short and leveraged ETFs is calculated on a daily basis.

An exchange-traded fund or ETF is an investment product representing a basket of securities that track an index such as the Standard Poors 500 Index. Short ProShares ETFs are non-diversified and entail certain risks including risk associated with the use of derivatives swap agreements futures contracts and similar instruments imperfect benchmark correlation leverage and market price variance all of which can. ETFS DAX Daily 2x Short GO ETF.

The fund like most geared. 3 реда ETF Name Ticker Leverage Benchmark Index. Symbol Grade Name Close Volume Vol Surge.

Investors should note that the leverage on SPXS resets on a daily basis which results in compounding of returns when held for multiple periods. ETFs which are available to individual investors only through brokers and advisers trade like stocks on an exchange. Compounding can lead to slippage over time between the index and the ETF.

Obtain higher levels of exposure to a broad market index while using less capital. The ProShares UltraPro Short SP 500 SPXU is a leveraged inverse exchange traded fund ETF that aims at a return that is three times the inverse of the daily performance of the SP 500. ProShares Short SP500 ETF SH.

ETFs Exchange Traded Funds sind eine sehr gute Möglichkeit um an der Entwicklung eines ganzen Marktes teilzuhabenSei es der deutsche Aktienmarkt über DAX ETFs sei es die Eurozone über Euro Stoxx 50 ETFs sei es der US-Markt mit marktbreiten SP 500 ETFs. The fund allows investors a tactical trading alternative to selling out of an existing position and creating a. Short gehen mit ETFs Ideal zur Depotabsicherung.

3x ETFs Exchange Traded Funds 3x Short SP ETF. Aber sie sind nicht nur ein praktisches Tool um auf einfache. A sortable list of Exchange Traded Funds ETFs that can be used to short the market or sectors of the market.

ETFs buy and sell stocks that track the value of the average it follows such as the Russell 2000. This ETF also offers unleveraged inverse exposure to the daily performance of the SP 500 index.

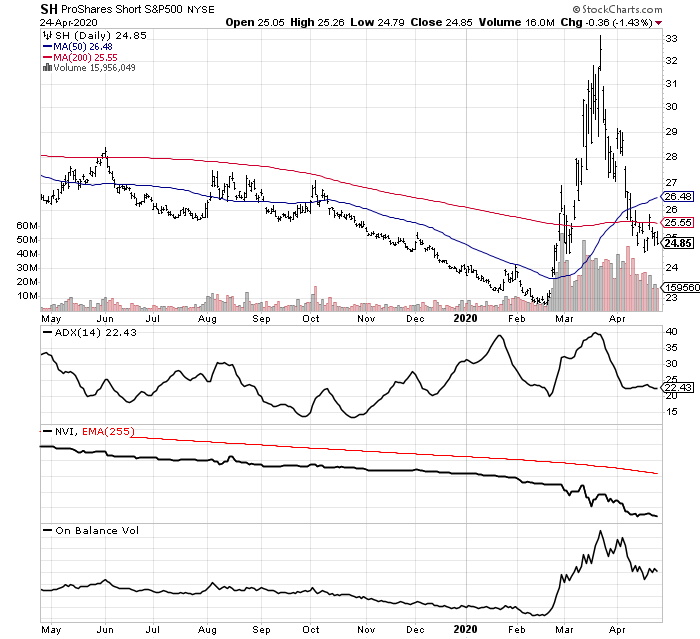

Sh An Effective Way To Short The Market In Your Ira Nysearca Sh Seeking Alpha

Sh An Effective Way To Short The Market In Your Ira Nysearca Sh Seeking Alpha

Spx Long Short Momentum Algorithm Beats S P500 By A Huge Margin For Amex Spy By Koi Capital Tradingview

Spx Long Short Momentum Algorithm Beats S P500 By A Huge Margin For Amex Spy By Koi Capital Tradingview

Obratni Etfs Da Pritezhavate Ako Pazart Rezervoari Firmeni Novini 2021

Obratni Etfs Da Pritezhavate Ako Pazart Rezervoari Firmeni Novini 2021

Sh Spx Inverse Etf Watching For Amex Sh By Mattarmstrong Tradingview

Sh Spx Inverse Etf Watching For Amex Sh By Mattarmstrong Tradingview

3 Leveraged Etfs To Trade A Stock Market Correction

3 S P 500 Inverse Etfs To Hedge Your Portfolio Against A Looming Correction Seeking Alpha

3 S P 500 Inverse Etfs To Hedge Your Portfolio Against A Looming Correction Seeking Alpha

Inverse Etfs Could Surge If Stocks Continue To Tumble Etf Trends

Inverse Etfs Could Surge If Stocks Continue To Tumble Etf Trends

Proshares Ultrapro And Ultrapro Short Etfs

Proshares Ultrapro And Ultrapro Short Etfs

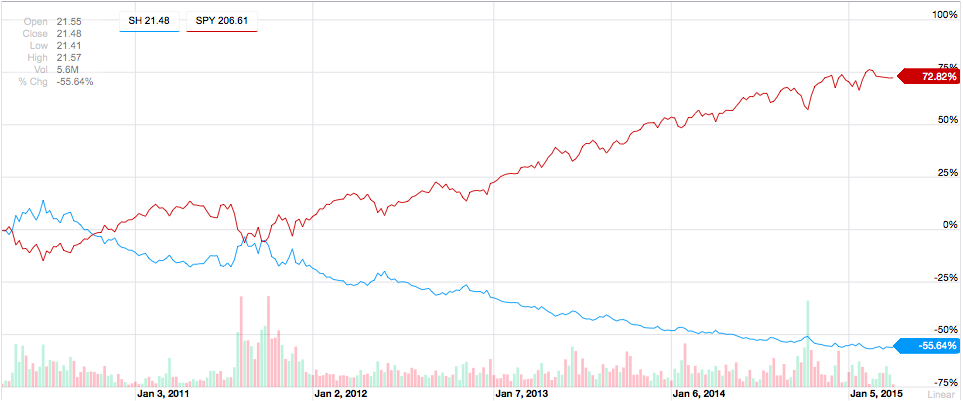

Why It S A Bad Idea To Buy The Proshares Short S P 500 Etf Nysearca Sh Seeking Alpha

Why It S A Bad Idea To Buy The Proshares Short S P 500 Etf Nysearca Sh Seeking Alpha

Spdr S P 500 Etf Spy Short Bets Are On The Rise Bloomberg

Spdr S P 500 Etf Spy Short Bets Are On The Rise Bloomberg

Inverse Index Etfs Bear With Them In January

Benefits Of Short Selling Inverse Leveraged Etfs Seeking Alpha

Benefits Of Short Selling Inverse Leveraged Etfs Seeking Alpha

Stabilize Your Investment Portfolio With An Inverse Etf

An Inverse Etf For Exposure To Bearish Daily S P 500 Returns Investing Com

An Inverse Etf For Exposure To Bearish Daily S P 500 Returns Investing Com

Comments

Post a Comment