Featured

Central Bank Gold Reserves

This page provides values for Gold Reserves reported in several countries. The central bank referred to gold as one of the most crucial reserve assets worldwide stating that it carries no credit or counterparty risks Hungarys latest addition was the biggest monthly purchase since June 2019 when Poland bought 949 tons according to the World Gold Council WGC data.

Why The World S Central Banks Hold Gold In Their Own Words Snbchf Com

Why The World S Central Banks Hold Gold In Their Own Words Snbchf Com

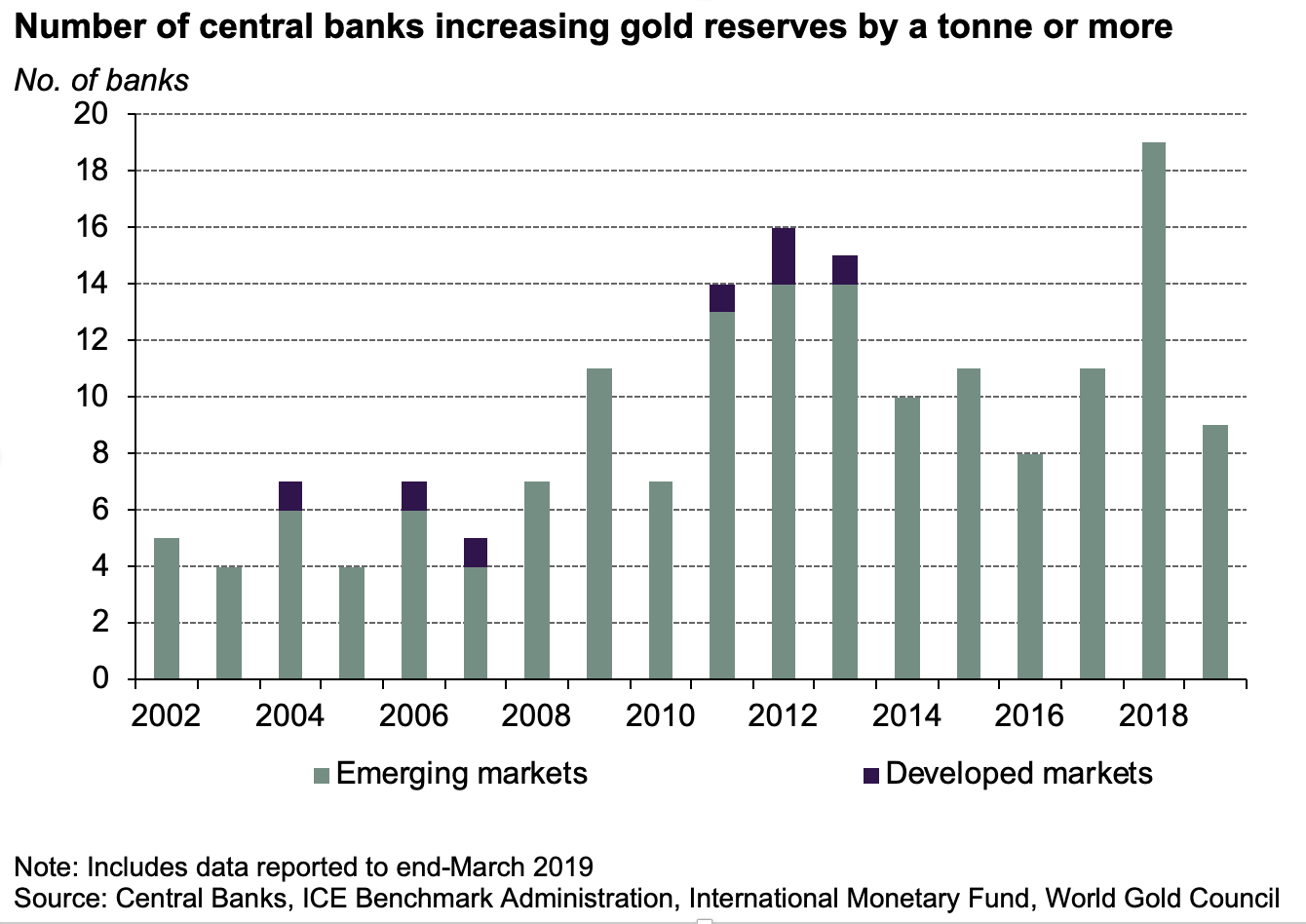

According to the 2020 Central Bank Gold Reserves CBGR survey 20 of central banks intend to increase their gold reserves over the next 12 months compared to just 8 of respondents in the 2019 survey.

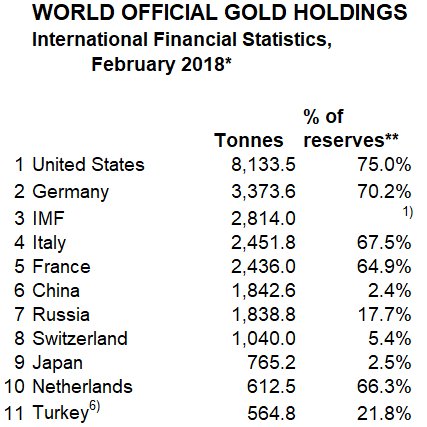

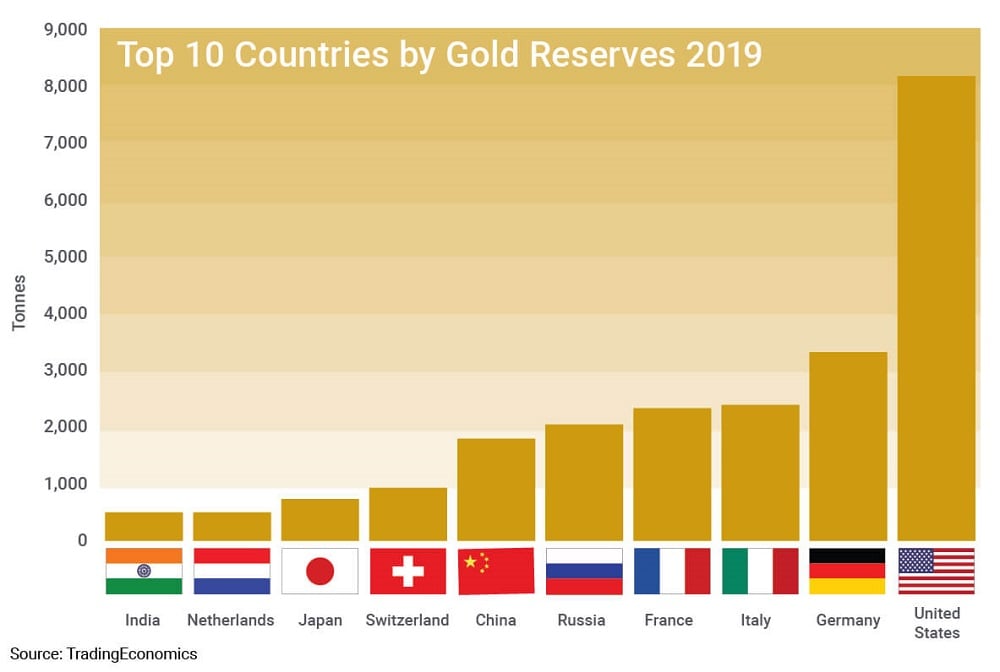

Central bank gold reserves. Collectively the banks are responsible for 344 billion worth of gold with an average holding of 13 billion. The US central bank holds the largest amount of gold reserves. It is an asset that is well suited to meeting central banks.

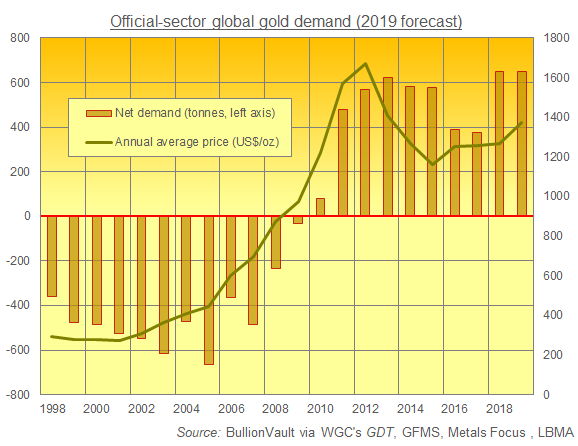

By Nick Carver and Robert Pringle 10 Nov 2020. This gold reserve data compiled using IMF IFS statistics tracks central banks reported purchases and sales along with gold as a percentage of their international reserves. Central Banks gold purchases are on track to set a 50-year high Sienkiewicz tweeted.

The vast majority of central bank gold holdings were acquired in. Investment Analyst Sebastian Sienkiewicz believes its because gold is a reliable safe-haven asset. According to the 2020 Central Bank Gold Reserves CBGR survey 20 of central banks intend to increase their gold reserves over the next 12 months compared to just 8 of respondents in the 2019 survey.

The interactive map below enables you to compare. Uzbekistan was the biggest buyer adding 84 tons to its reserves. Gold plays an important part in central banks reserves management and they are significant holders of gold.

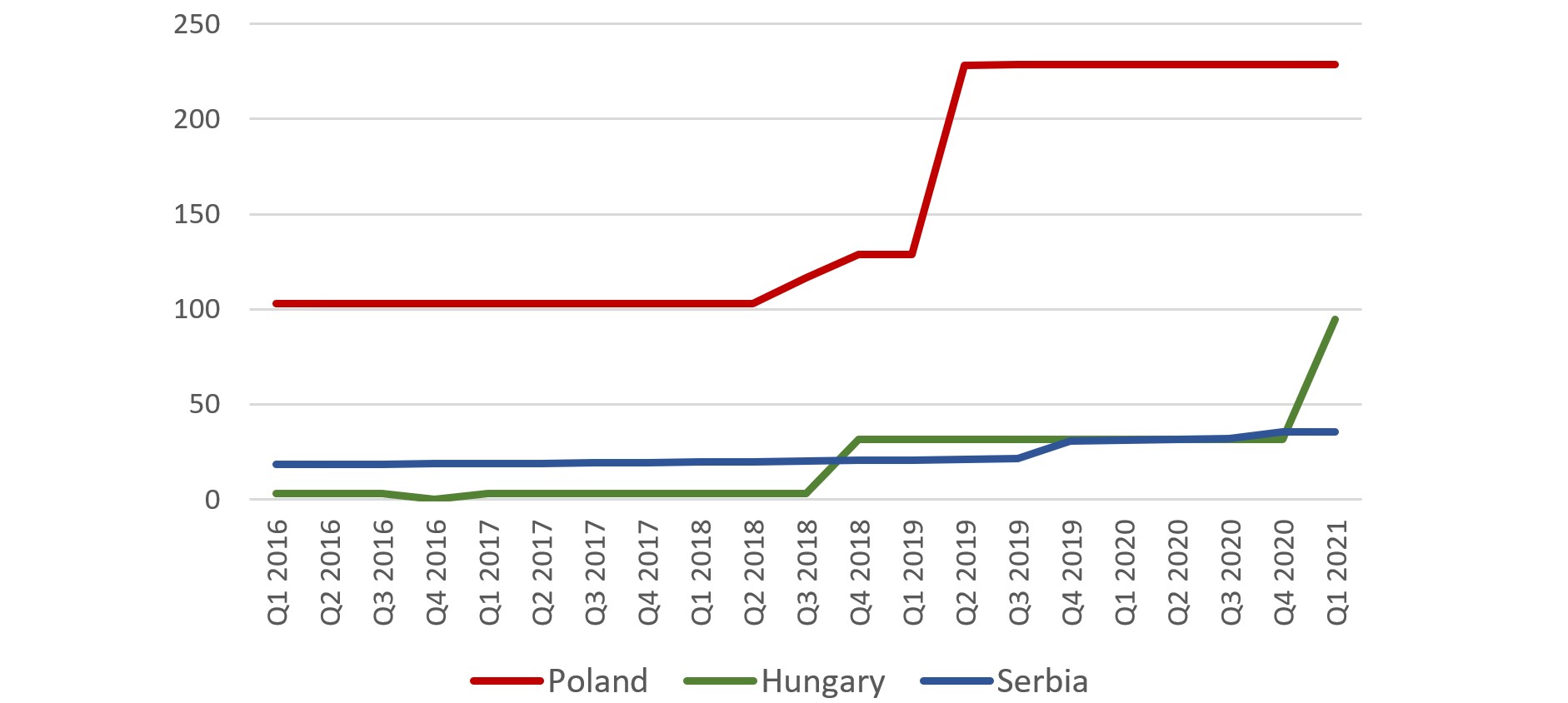

Suddenly governments their treasuries or central banks had unprecedented flows of gold from America and Australia which could fill their reserves or enable their mints to make gold coins which found their way into the pockets of millions of people world-wide replacing the silver coins that had pre-dominated before. Buying continued at roughly the same pace as the previous two months but there were no big sellers in October. Hungary tripled its gold reserves in one of the biggest purchases by a central bank in decades -- the latest sign of governments turning to the.

READ MORE Silver Investment Demand Explosion and Other Silver News. 52 Zeilen Central Bank Gold Reserves Estimated data. A host of nations nailed the gold.

The table has current values for Gold Reserves previous releases historical highs and record lows release frequency reported unit and currency plus links to historical. Gold as a reserve asset. In October central banks added a net 228 tons of gold to their reserves according to the latest data compiled by the World Gold Council.

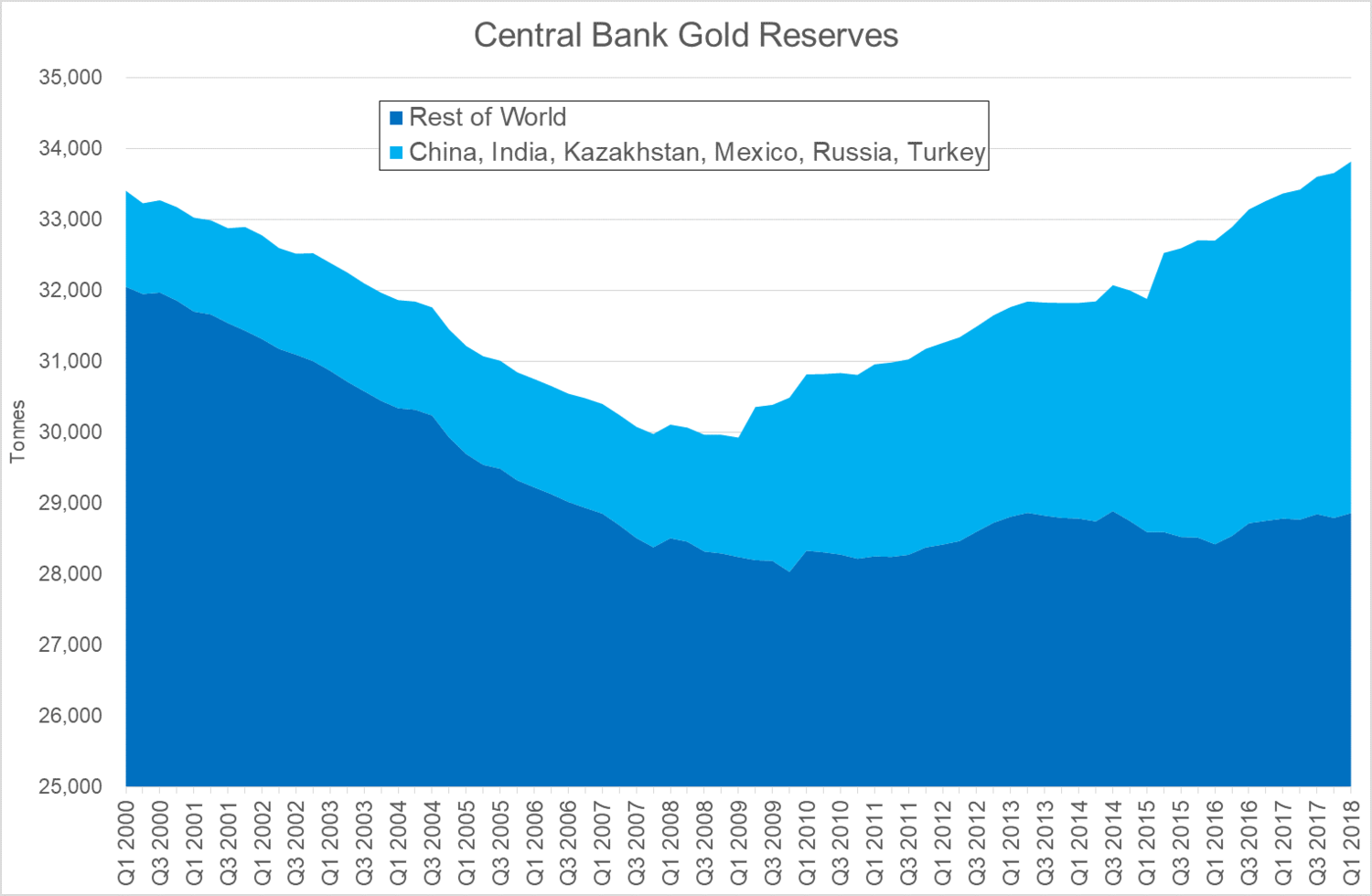

A number of market observers have different opinions on why the worlds central banks are stockpiling gold reserves. Gold reserves in central banks 2020 survey results Reserve managers share their views on future gold holdings target allocations purchasing and storage approaches the use of ETFs and the impact of Covid-19 in the results of a new joint Central Banking-Invesco survey. Central banks held 34000 tonnes 1 of gold as of Q1 2019 according to IMF data making gold the third largest reserve asset in the world.

The 26 central banks are as a group responsible for just over 26 trillion in reserves as of June 20201 The average holding was just over 100 billion. For more information see our Gold Demand Trends report. 52 Zeilen A gold reserve is the gold held by a national central bank intended.

Global central bank gold reserves top 33000 tonnes approximately one-fifth of all the gold ever mined. Most European central banks have gold reserves above the 50 mark of their reserves despite mostly selling gold over the past two decades. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - Gold Reserves.

2020 Central Bank Gold Reserve Survey The number of central banks buying gold is expected to increase substantially this year. Gold is generally considered to be a strategic asset that can be deployed for both short-term liquidity management and as a store of value over time. The increase is particularly notable as central bank buying has reached record levels in recent years adding around 650 tonnes in 2019 alone.

Thus 1850 is the watershed. The group included six central banks with no gold reserves. On the other hand China and India have been aggressively.

Central banks globally added a net 795 tons of gold to their reserves in March led by a major purchase by Hungary according to the latest data compiled by the World Gold Council.

Emerging Markets Dominate Central Bank Gold Buying Bonanza Post By Shaokai Fan Gold Focus Blog World Gold Council

Emerging Markets Dominate Central Bank Gold Buying Bonanza Post By Shaokai Fan Gold Focus Blog World Gold Council

Central And Eastern European Central Banks Significantly Expand Their Gold Reserves Post By Dr Tatiana Fic Gold Focus Blog World Gold Council

Central And Eastern European Central Banks Significantly Expand Their Gold Reserves Post By Dr Tatiana Fic Gold Focus Blog World Gold Council

Germany Repatriates Gold Reserves Ahead Of Schedule Business Economy And Finance News From A German Perspective Dw 23 08 2017

Germany Repatriates Gold Reserves Ahead Of Schedule Business Economy And Finance News From A German Perspective Dw 23 08 2017

Monetary Gold Reserves Of Ecb 2019 Statista

Monetary Gold Reserves Of Ecb 2019 Statista

Worldwide Major Central Banks Are Accumulating Their Gold Holdings Kitco News

Worldwide Major Central Banks Are Accumulating Their Gold Holdings Kitco News

Top 10 Countries With Largest Gold Reserves Lawrieongold

Top 10 Countries With Largest Gold Reserves Lawrieongold

Central Banks Positivity Towards Gold Will Provide Long Term Support To Gold Prices Snbchf Com

Central Banks Positivity Towards Gold Will Provide Long Term Support To Gold Prices Snbchf Com

Central Banks Make Record 15 7bn Gold Purchases Financial Times

Central Banks Are Repatriating Gold Hard Times Ahead

Central Banks Are Repatriating Gold Hard Times Ahead

Central Bank Gold Agreement Dead At 20 Gold News

Central Bank Gold Agreement Dead At 20 Gold News

Global Gold Reserve Central Banks First Quarter Gold Buying At Highest Since 2013 The Economic Times

Global Gold Reserve Central Banks First Quarter Gold Buying At Highest Since 2013 The Economic Times

Gold Reserves By Country Top 10 Largest Gold Reserves Bullionbypost

Gold Reserves By Country Top 10 Largest Gold Reserves Bullionbypost

Comments

Post a Comment