Featured

Opportunity Zone Funds List

Get started or dive deeper into Opportunity Zones and Opportunity Fund Development. The 10M Campustown Opportunity Zone Fund I was oversubscribed in June 2019 and fully deployed by August 2019.

Using Qualified Opportunity Zone Funds To Avoid Capital Gains

Using Qualified Opportunity Zone Funds To Avoid Capital Gains

Here are the Opportunity Funds most recently listed in our Directory.

Opportunity zone funds list. An Opportunity Zone Fund investment provides potential tax savings in three ways. Where to start what you need and more. Total Fund Size Authorized.

List of designated Qualified Opportunity Zones QOZs. IRS Delays Opportunity Zone Investment Deadline Due to COVID-19. Opportunity Funds are the hub of the wheel.

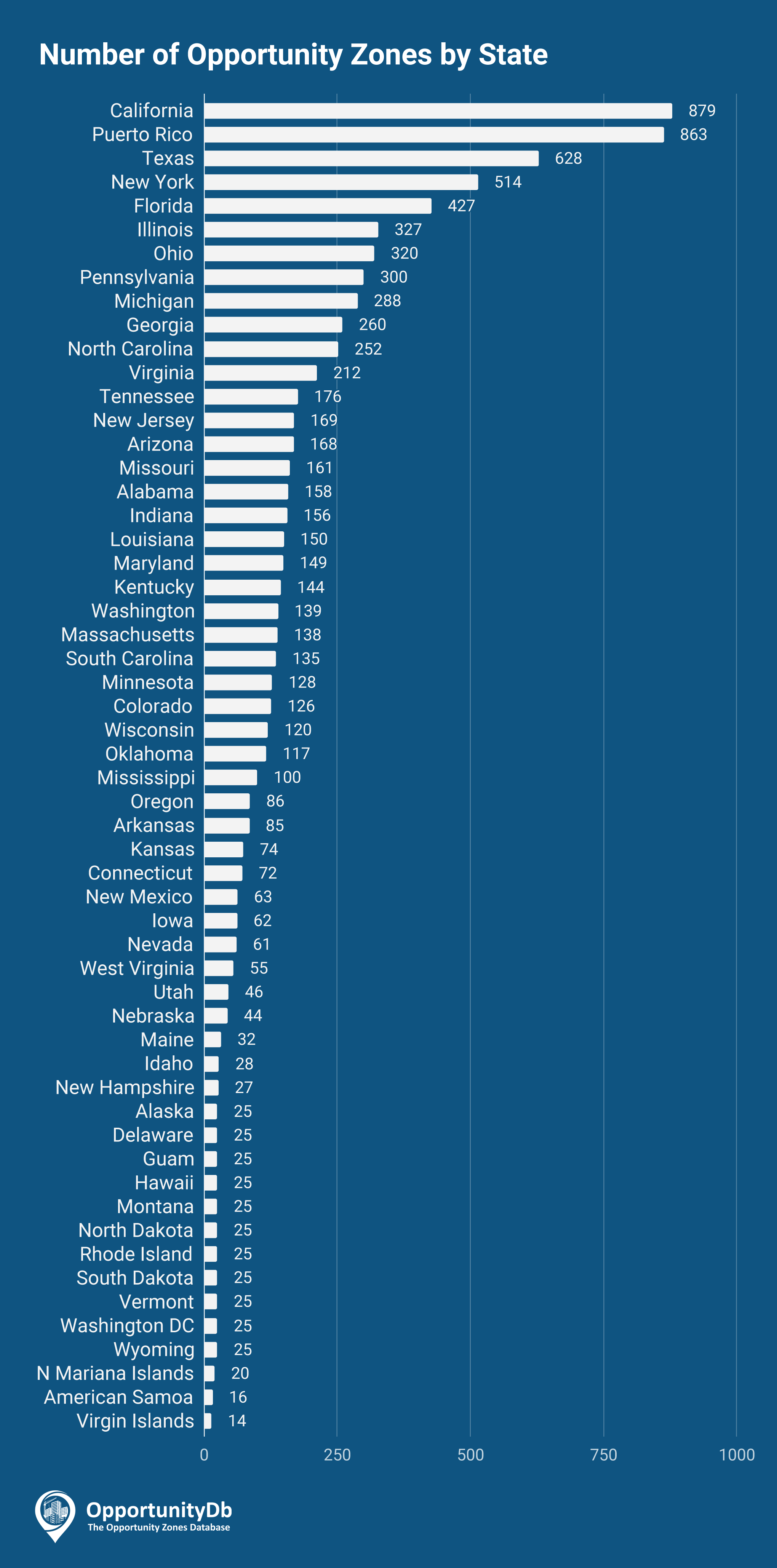

List of Opportunity Zones by State. Churchill Prima Fund Opportunity Zone Fund. Here is the breakdown by state.

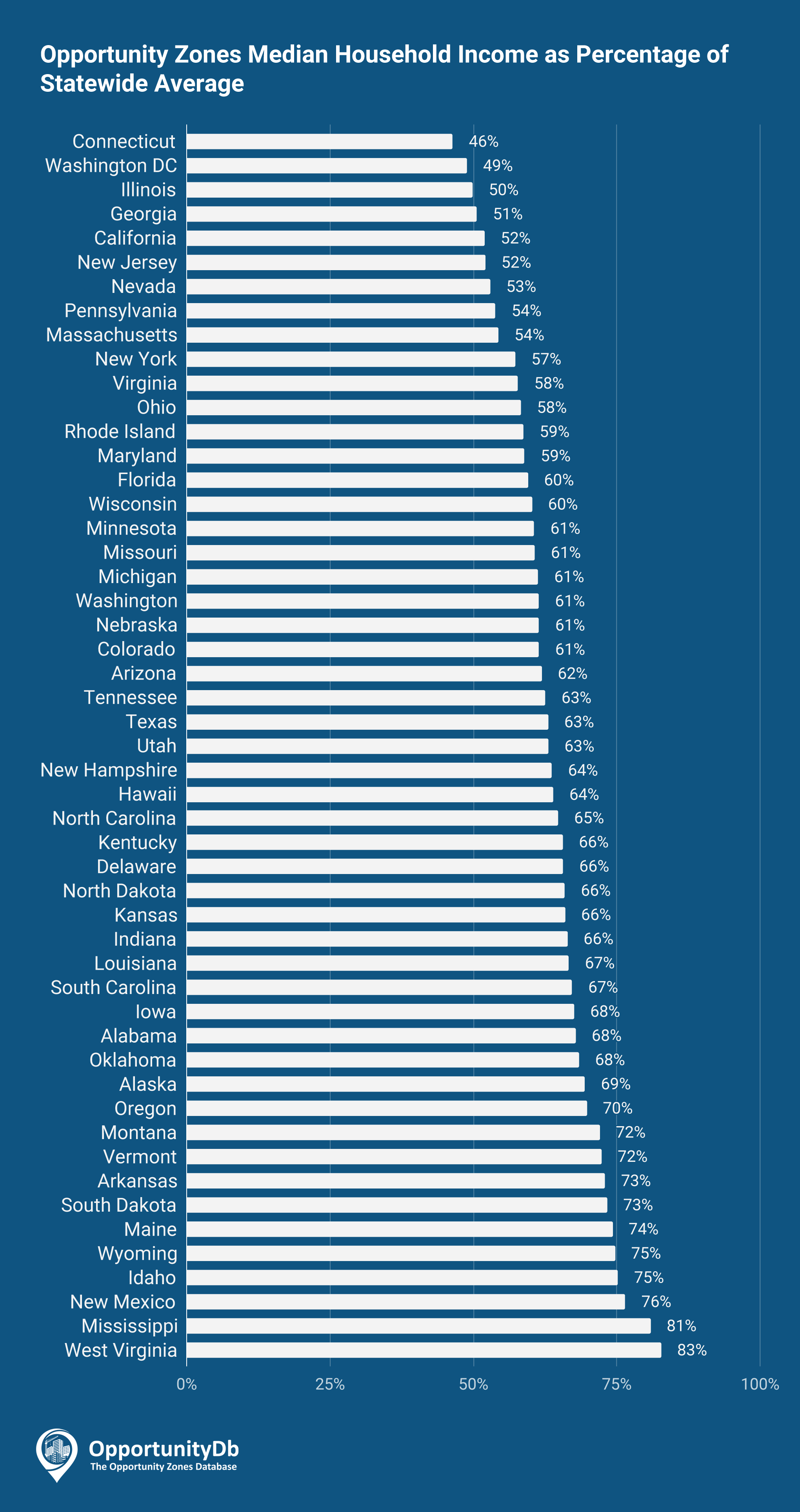

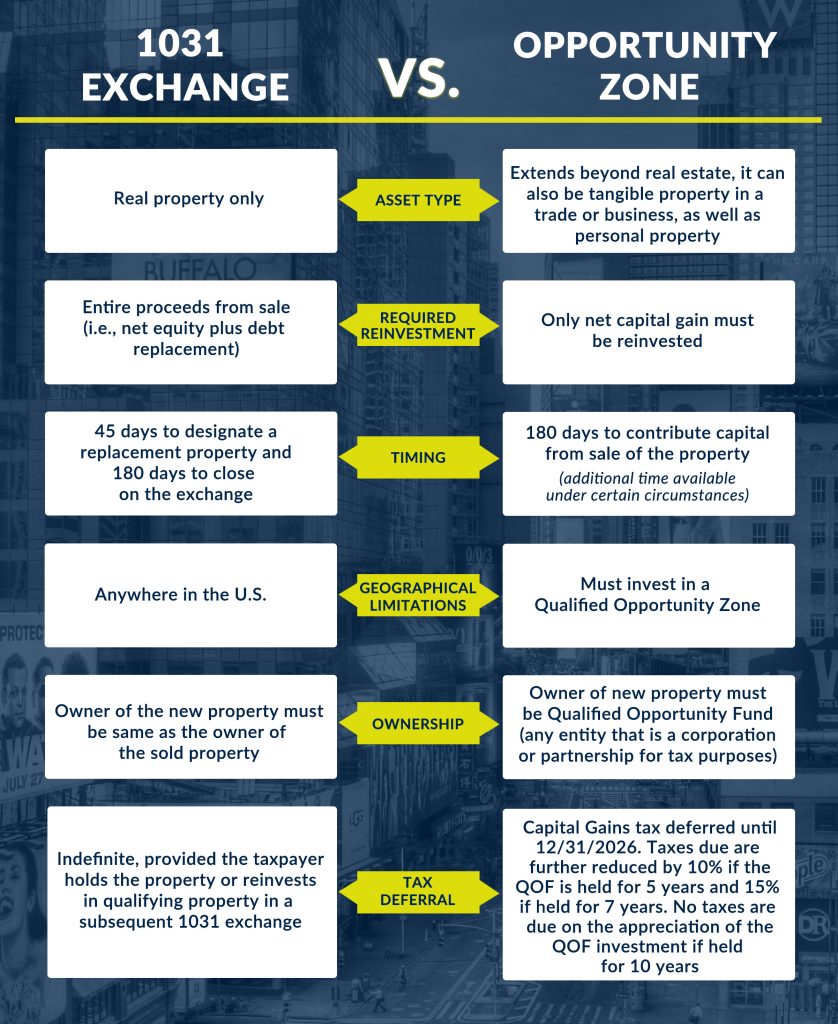

It does require that 90 of opportunity zone fund assets be invested in an opportunity zone there are over 8700 across the US. Opportunity Zone Fund Listings. Qualified Opportunity Zone Funds are new investment vehicles created as part of the Tax Cuts and Jobs Act of 2017 to incentivize investment in targeted communities called Opportunity Zones which are census tracts designated by state and federal governments targeted for economic development.

Find a census tract. In terms of real estate the qualified property must be a business property which can include multi family real estate that is operated as a rental business. And that a business retain 70 of its tangible property in.

The Internal Revenue Service issued Notice 2021-10 providing additional relief to taxpayers affected by the coronavirus pandemic. Chestnut Opportunity Zone Fund LP Chestnut Funds Steen Watson 7035088262 email protected Southeast mid-Atlantic. There are more than 8760 designated Qualified Opportunity Zones PDF located in all 50 States the District of Columbia and five United States territories.

Opportunity Funds in turn invest that money in Opportunity Zone Projects. In return for these investments investors receive several tax benefits which vary depending upon the time capital remains invested in a Qualified Opportunity Zone QOZ Fund. Jackson Dearborn Partners was one of the first groups in the country to launch fulfill and deploy an Opportunity Zone Fund.

Overseas territories and Washington DC are also included. JDP is actively raising capital for new Opportunity Zone funds and individual projects more details on the Investment Opportunities. The right connections with the right answers.

Taxpayers invest Capital Gains in Opportunity Funds to achieve tax benefits. We have developed more opportunity funds than any other entity in the country. For the notice including additional Puerto Rico Designated Qualified Opportunity Zones please click here.

27 rânduri 1787 Capital Opportunity Zone Fund 50000000 Alabama. Each Qualified Opportunity Zone Fund must ensure it follows the set regulations in order to qualify for any tax benefits These funds invest in Qualified Opportunity Zone Property. Total Fund Stock Round A.

A listing of opportunity zone funds seeking to make investments in Maryland. Taxpayers can invest in these zones through Qualified Opportunity Funds. Tax deferral through 2026 - A taxpayer may elect to defer the tax on some or all of a capital gain if during the 180 day period beginning at the date of saleexchange they invest in a qualified opportunity fund.

Invest in a Qualified Opportunity Fund. Investors can find a list of qualified opportunity funds from the National Council of State Housing Agencies NCSHA Opportunity Zone Fund Directory which allows you to filter the funds. Click here to learn how to list your Opportunity Fund.

You can support economic development in Qualified Opportunity Zones and temporarily defer tax on eligible gains when you invest in a Qualified Opportunity Fund. Residential mixed-use office development. The payment of your capital gains until December 31 2028.

There are three primary advantages to rolling over a capital gain into a qualified Opportunity Zone Fund. 101 rânduri King Tide Capital Opportunity Zone Fund. Investors can defer tax on any prior gains invested in a Qualified Opportunity Fund QOF until the earlier of the date on which the investment in a QOF is sold or exchanged or until December 31 2026.

Let us develop your opportunity fund turn key for you. For a list of the census tracts designated by the Secretary of the Treasury as Opportunity Zones in July 2018 please click here. REVIVE Qualified Opportunity Zone Fund from Opportunity Zones on Vimeo.

Any taxable gain invested in an Opportunity Zone. Certify and Maintain a Qualified Opportunity Fund. There are 8764 opportunity zones in the United States.

Certes Partners Opportunity Zone Fund Certes Partners Sunder Jambunathan 2129207630 email protected NYC. Medical office retail and mixed-use. Effective January 1 the benefit drops to 10 after 5 years.

This spreadsheet was updated December 14 2018 to include two additional census tracts in Puerto Rico that based on 2012-2016 American Community Survey data meet the statutory criteria for a Low-Income Community and are deemed as designated QOZs.

Opportunity Zones Department Of Economic Development

Opportunity Zones Department Of Economic Development

Opportunity Zones By Location Opportunitydb

Opportunity Zones By Location Opportunitydb

Opportunity Zones Facts And Figures Economic Innovation Group

Opportunity Zones Facts And Figures Economic Innovation Group

Opportunity Funds List Novogradac

Opportunity Funds List Novogradac

Opportunity Zones Seven Peaks Ventures

Using Qualified Opportunity Zone Funds To Avoid Capital Gains

Using Qualified Opportunity Zone Funds To Avoid Capital Gains

Opportunity Zone Fund Directory Ncsha

Opportunity Zone Fund Directory Ncsha

Business Oregon Opportunity Zones

Urban Catalyst Makes Forbes Top 20 Opportunity Zone List

Urban Catalyst Makes Forbes Top 20 Opportunity Zone List

Opportunity Zones By Location Opportunitydb

Opportunity Zones By Location Opportunitydb

List Of Qualified Opportunity Zone Funds Ready For Investment

List Of Qualified Opportunity Zone Funds Ready For Investment

Comments

Post a Comment